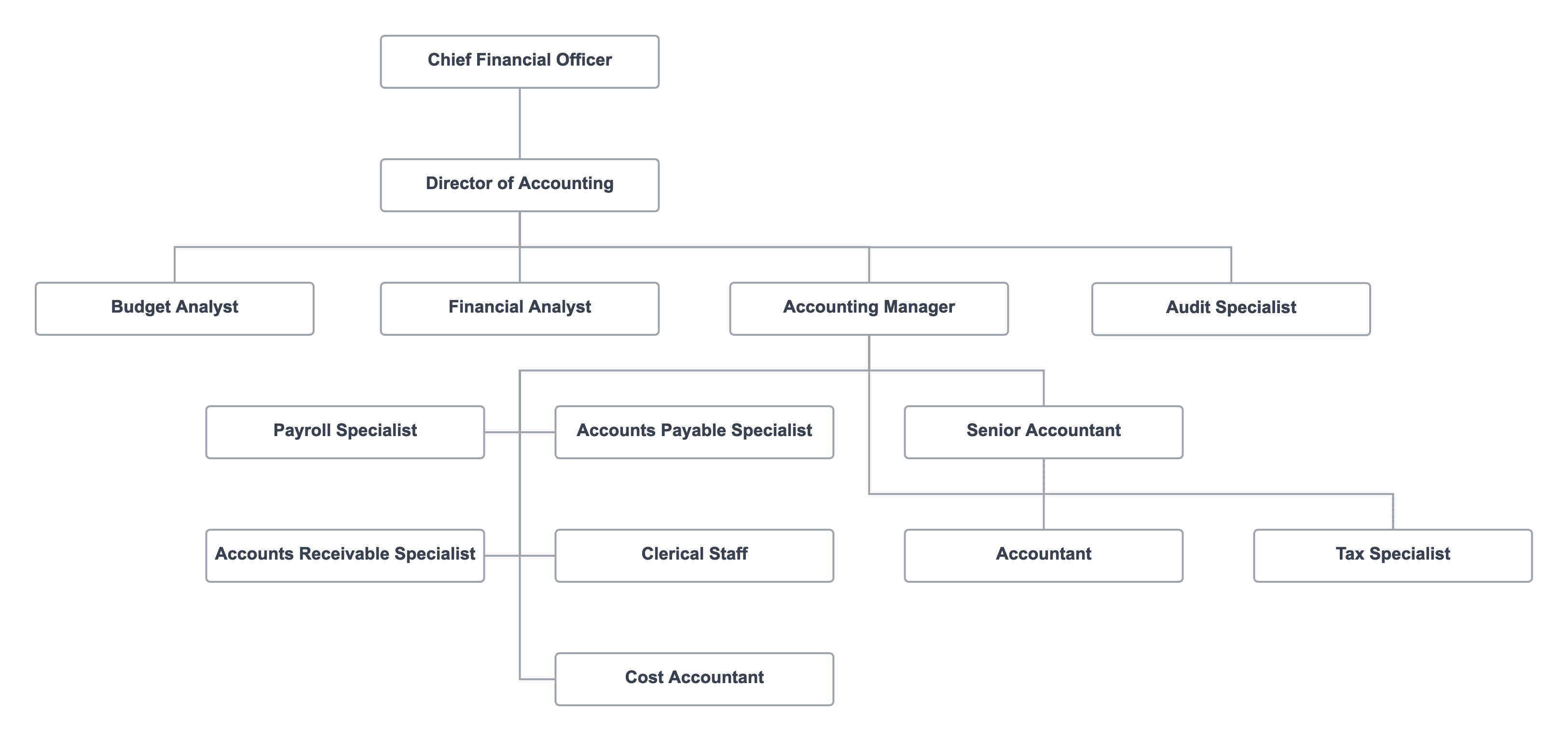

Accounting Department Org Chart

To create an accounting department organization chart, we might outline the following structure and roles (see also accounting department structure):

- CFO: The highest level of the organization, responsible for overall strategy and direction of the accounting department, as well as the financial performance of the organization.

- Director of Accounting: Reports to the CFO, responsible for managing the overall operation of the accounting department and ensuring that financial reports and records are accurate and compliant with relevant laws and regulations.

- Accounting Manager: Reports to the Director of Accounting, responsible for managing the day-to-day operations of the department, including managing the work of accountants and other staff.

- Senior Accountant: Reports to the Accounting Manager, responsible for maintaining financial records, preparing financial statements, and ensuring that transactions are recorded accurately and in a timely manner.

- Accountant: Reports to the Senior Accountant, also responsible for maintaining financial records, preparing financial statements, and ensuring that transactions are recorded accurately and in a timely manner.

- Tax specialist: Reports to the Senior Accountant or the Accounting Manager, responsible for managing the organization's tax compliance and filing.

- Cost Accountant: Reports to the Accounting Manager, responsible for cost analysis, inventory accounting and other cost-related tasks.

- Financial Analyst: Reports to the Accounting Manager or the Director of Accounting, responsible for financial forecasting, budgeting, and other financial analysis tasks.

- Accounts Payable Specialist: Reports to the Accounting Manager, responsible for managing the organization's incoming payments.

- Accounts Receivable Specialist: Reports to the Accounting Manager, responsible for managing the organization's outgoing payments.

- Payroll Specialist: Reports to the Accounting Manager, responsible for managing the organization's payroll, including processing employee paychecks and handling taxes and deductions.

- Audit Specialist: Reports to the Director of Accounting, responsible for internal and external audits to ensure the department is operating efficiently and effectively, and that financial records are accurate and compliant with relevant laws and regulations.

- Budget Analyst: Reports to the Director of Accounting, responsible for creating and monitoring the organization's budget.

- Clerical Staff: Reports to the Accounting Manager or the support staff, responsible for data entry, record keeping, and other administrative support tasks.

This is one possible organizational chart for an accounting department of 12-15 people.

This chart is available to download as an accounting department org chart template to use with Lexchart.

Learn more about management organization charts in Organization Charts: the Complete Guide.

How to use an organization chart template

Get free templates for organization charts, company structure charts, and governance charts. Learn how to use templates in Lexchart.