Who Owns and Controls Blackstone in 2024?

Blackstone, Inc. (NYSE: BX) is a publicly traded private equity firm founded in 1985 by Stephen Schwarzman and Peter Peterson. Headquartered in New York City, Blackstone stands as one of the largest private equity firms globally. This article delves into the disclosed beneficial owners and named executive officers to provide clarity on the ownership structure of Blackstone as of 2024.

Who Owns Blackstone in 2024

Blackstone's 10-K filing as of December 31, 2024, details the company's ownership structure. There are two primary classes of ownership interests: common stock, which is publicly traded, and partnership units, held by the company's directors, officers, and certain beneficial owners.

The following table outlines the ownership structure of Blackstone, Inc. as of December 31, 2023:

| Category | Entity/Individual | Shares | % of Shares | Partnership Units | % of Units |

|---|---|---|---|---|---|

| Blackstone Inc. | Directors & Officers | 2,507,757 | 286,353,011 | 63.2 | |

| Blackstone Inc. | Beneficial Owners | 108,958,684 | 15.2 | ||

| Beneficial Owners | Vanguard | 62,972,154 | 8.8 | ||

| Beneficial Owners | BlackRock | 45,986,530 | 6.4 | ||

| Directors & Officers | John G. Finley | 82,848 | < 1 | 411,155 | < 1 |

| Directors & Officers | Vikrant Sawhney | 220,038 | < 1 | 635,046 | < 1 |

| Directors & Officers | Kelly A. Ayotte | 13,989 | < 1 | ||

| Directors & Officers | James W. Breyer | 36,886 | < 1 | ||

| Directors & Officers | Reginald J. Brown | 12,707 | < 1 | ||

| Directors & Officers | Rochelle B. Lazarus | 55,343 | < 1 | ||

| Directors & Officers | Brian Mulroney | 177,431 | < 1 | ||

| Directors & Officers | William G. Parrett | 90,112 | < 1 | ||

| Directors & Officers | Ruth Porat | 40,195 | < 1 | ||

| Directors & Officers | Stephen Schwarzman | 231,924,793 | 51.2 | ||

| Directors & Officers | Jonathan D. Gray | 1,160,666 | < 1 | 40,939,600 | 9.0 |

| Directors & Officers | Michael S. Chae | 298,534 | < 1 | 6,313,287 | 1.4 |

| Directors & Officers | Joseph P. Baratta | 319,008 | < 1 | 6,129,130 | 1.4 |

Blackstone's ownership is characterized by its complexity, with significant portions held by directors and officers through partnership units. This concentration grants them considerable influence over the company's operations and strategic decisions. Additionally, major institutional investors like Vanguard and BlackRock hold substantial stakes, further diversifying the ownership landscape.

How is Ownership of Blackstone Structured?

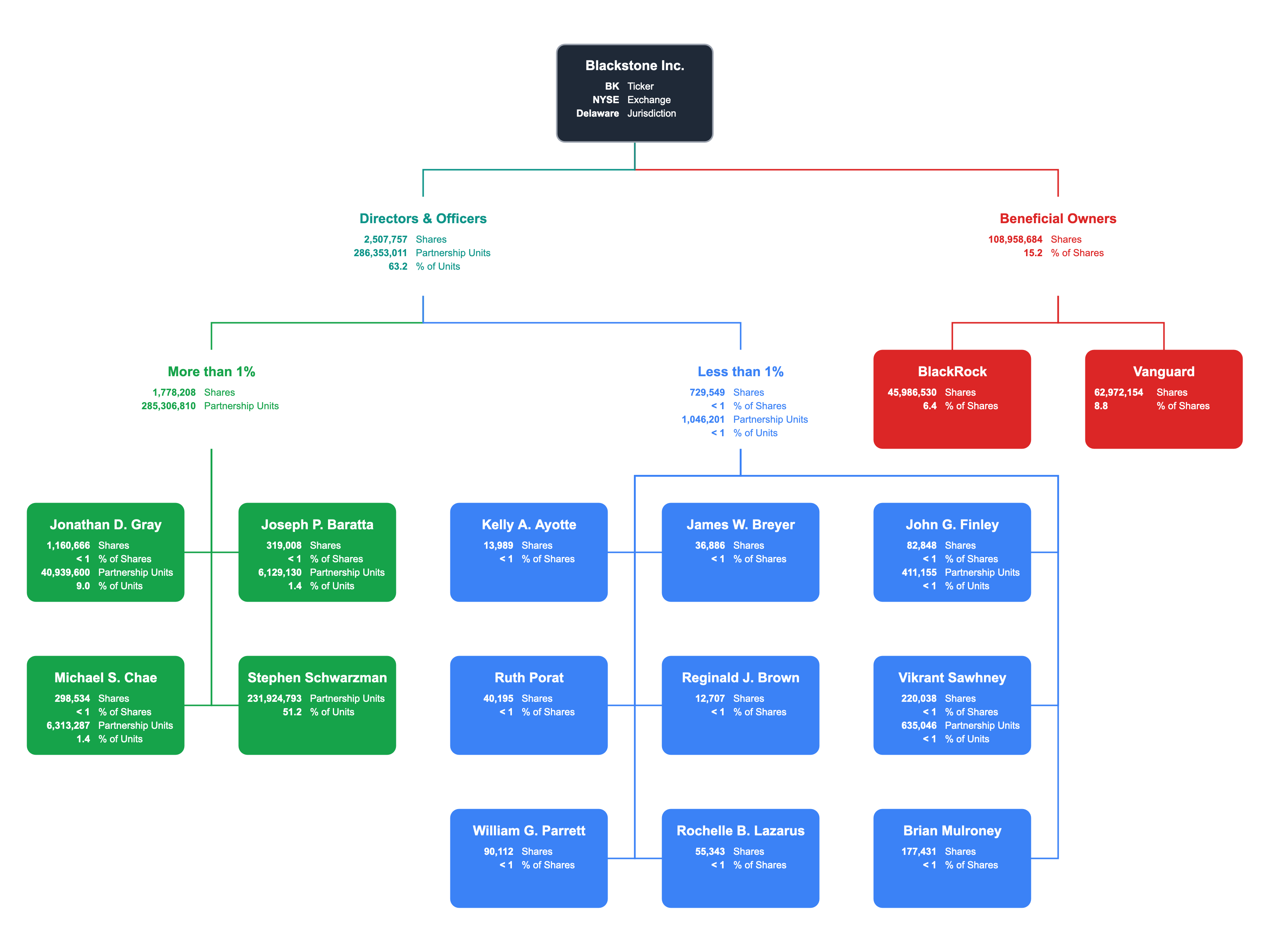

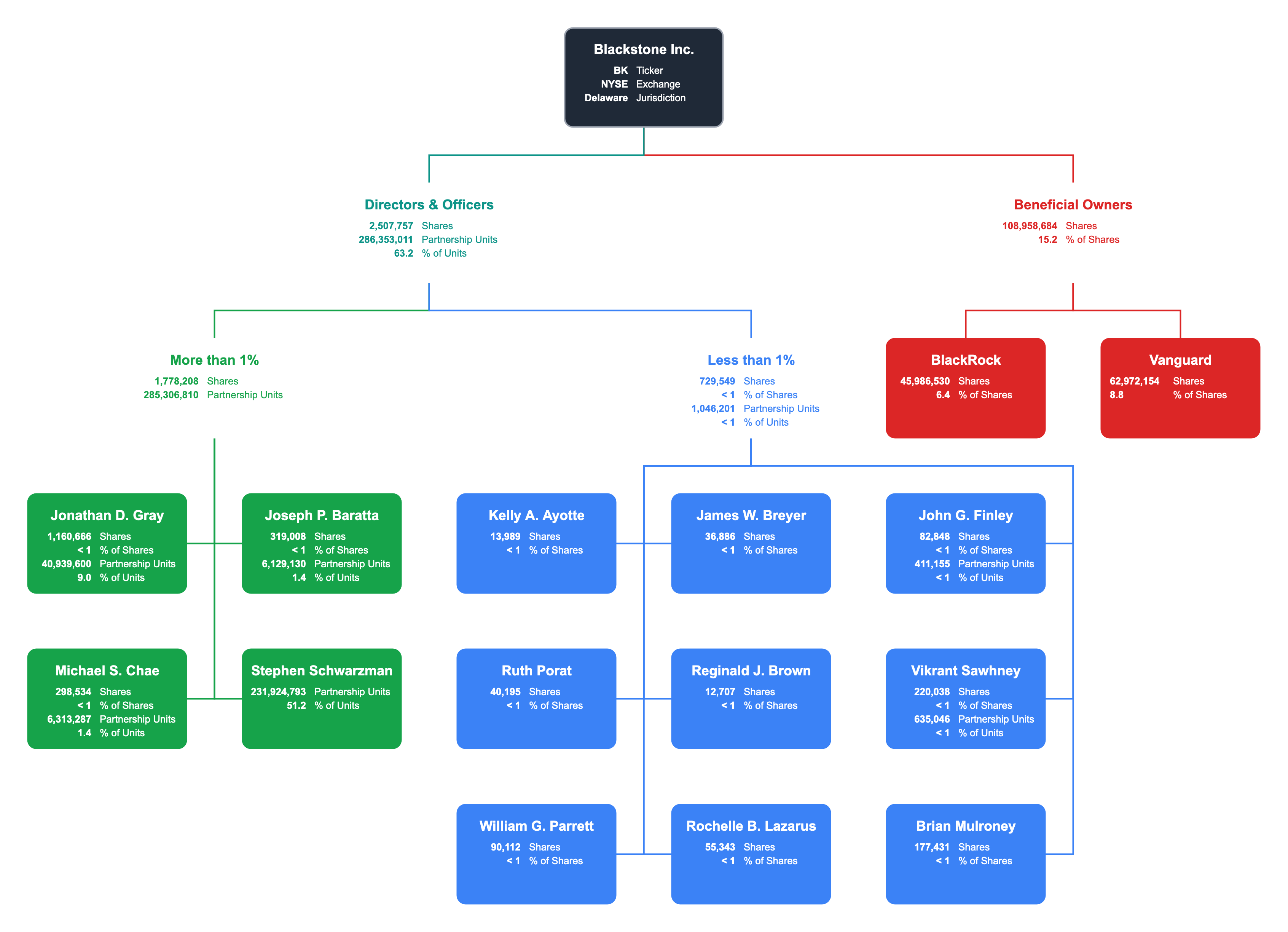

The organization chart below provides a visual representation of Blackstone's ownership structure, highlighting the different layers of control and influence within the company.

The dominance of the company's directors and officers is evident, with Stephen Schwarzman, Blackstone's co-founder and CEO, holding the largest individual stake at 51.2% of the partnership units. Other key figures, such as Jonathan D. Gray and Michael S. Chae, also maintain significant holdings, reinforcing their strategic positions within the company.

Institutional investors like Vanguard and BlackRock, despite holding smaller stakes in comparison, are crucial to Blackstone's shareholder base. Vanguard leads with 8.8% of the common stock, followed by BlackRock at 6.4%.

Conclusion

Blackstone, Inc.'s intricate ownership structure, blending public shareholders, directors, officers, and beneficial owners, reflects its stature as a leading private equity firm. Directors and officers, through their majority holdings in partnership units, wield substantial control, while institutional investors like Vanguard and BlackRock play a pivotal role in the company's equity landscape. This multifaceted ownership framework underscores Blackstone's position in the global private equity arena.

This chart is made with Lexchart for automatic organization charts.