Navigating M&A: A Comprehensive Guide to Visualizing Company Structures for Due Diligence

Mergers and acquisitions (M&A) are complex transactions that require a thorough understanding of the companies involved. Due diligence is a critical part of this process, as it enables decision-makers to identify risks, opportunities, and synergies. One essential aspect of due diligence is understanding the company structures of the organizations involved. In this article, we'll explore the importance of visualizing company structures during M&A due diligence and provide a comprehensive guide to creating effective diagrams using Lexchart.

The Importance of Visualizing Company Structures in M&A Due Diligence

Visualizing company structures through diagrams can play a significant role in M&A due diligence, offering numerous benefits:

Identifying potential conflicts of interest: By displaying the connections between parent and subsidiary companies, structure diagrams can help stakeholders identify potential conflicts of interest that may arise from the merger or acquisition.

Uncovering hidden risks: Visualizing company structures can reveal risks that may not be immediately apparent from financial statements and other documentation, such as tax liabilities or legal issues related to ownership.

Evaluating synergies: Company structure diagrams can help decision-makers identify areas where the merging companies can achieve operational efficiencies or other synergies, supporting the valuation process and informing negotiation strategies.

Facilitating integration: A clear understanding of the ownership structures of both companies can aid in planning for the integration of teams, departments, and resources after the merger or acquisition.

Creating Company Structure Diagrams with Lexchart for M&A Due Diligence

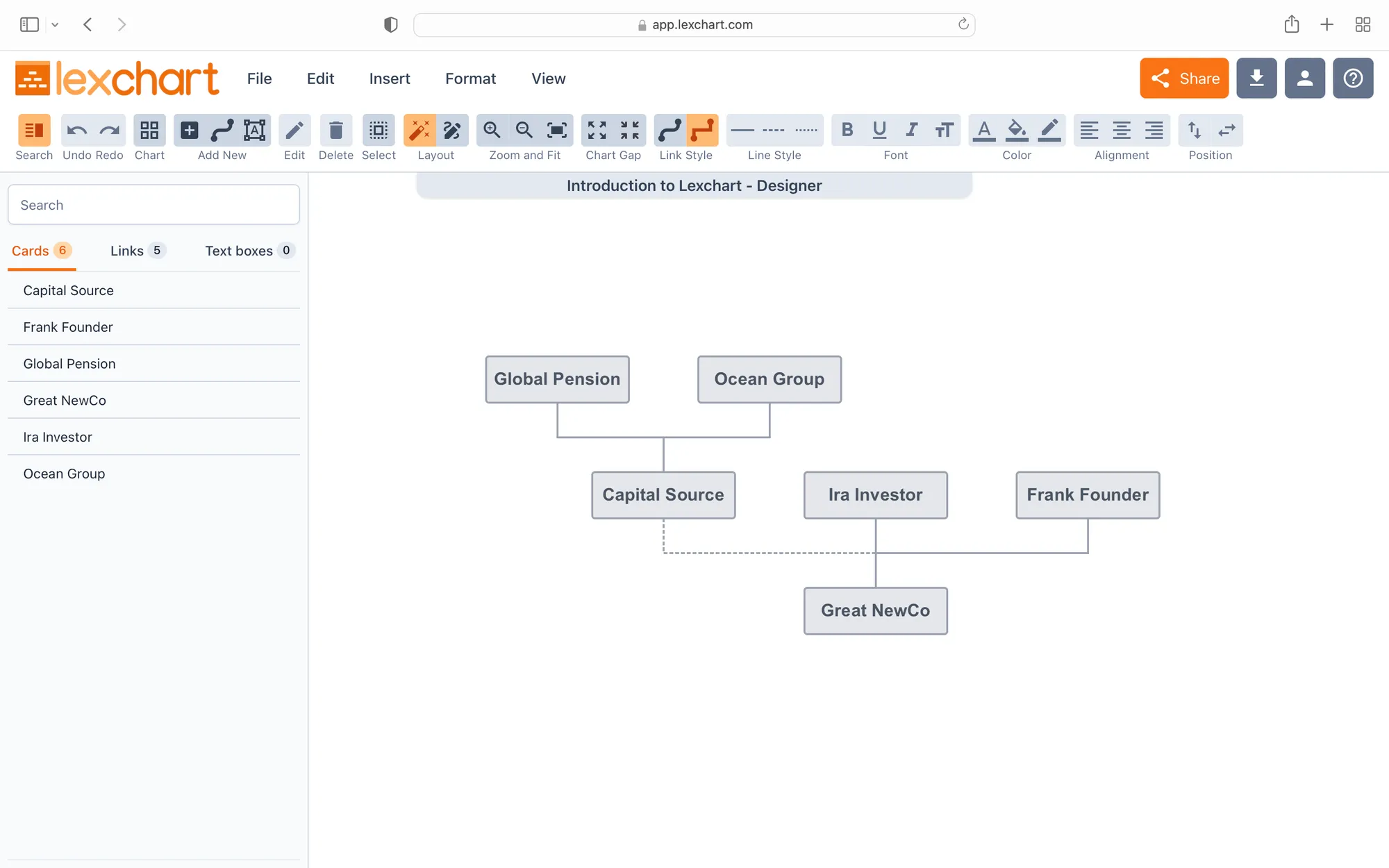

Lexchart is a powerful tool for creating company structure diagrams, offering advanced features and an intuitive interface that simplifies the process. Here's how to use Lexchart to create company structure diagrams for M&A due diligence:

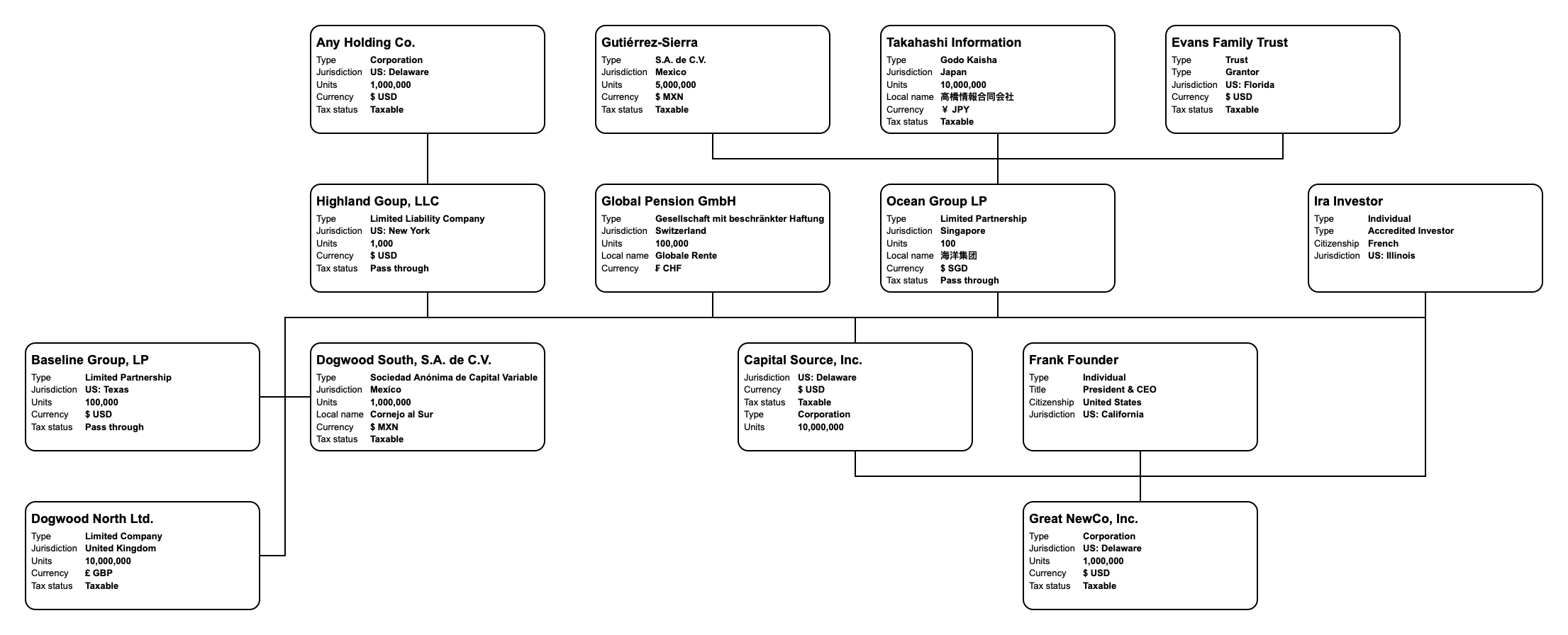

Step 1: Gather and Organize Data

Begin by collecting all relevant data on the ownership structures of the companies involved in the M&A transaction. This may include information on parent and subsidiary companies, their ownership percentages, and jurisdiction details. Ensure that your data is accurate, up-to-date, and well-organized to create an informative and reliable diagram.

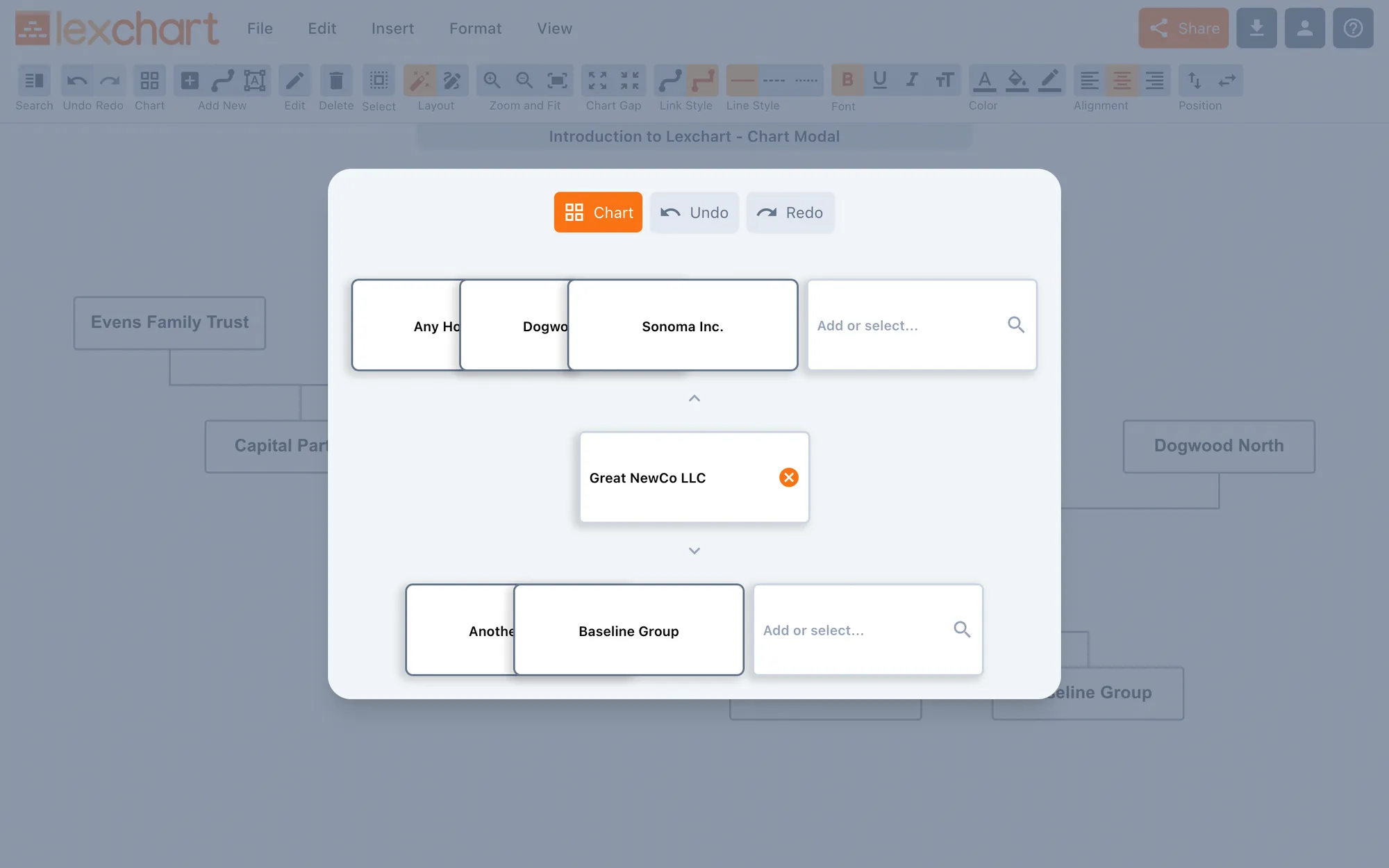

Step 2: Import Data into Lexchart

Once your data is ready, import it into Lexchart using either a CSV file or manual input. Lexchart will use this information to generate an initial company structure diagram.

Step 3: Select the Appropriate Layout

Use automatic layout as you build out the structure. You can switch to manual mode to alter the design.

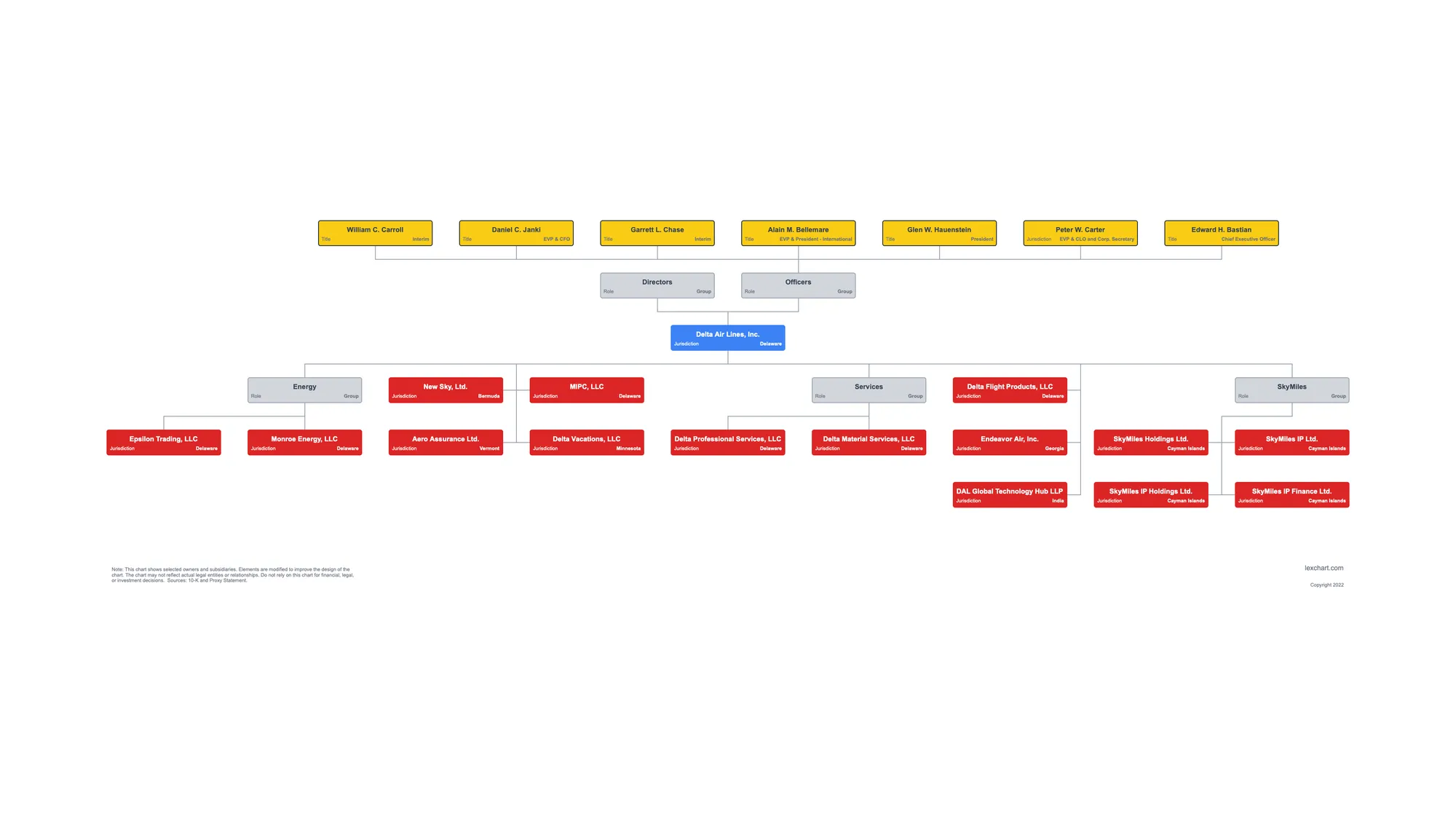

Step 4: Customize the Visual Design

Customize the appearance of your company structure diagram using Lexchart's design tools. Apply a consistent visual style by selecting colors, fonts, and shapes that align with your organization's branding. This will enhance the readability of your diagram and help stakeholders quickly grasp the information it conveys.

Step 5: Add Relevant Information and Annotations

Include key details in your company structure diagram, such as company names, ownership percentages, and jurisdiction information. This will provide context for the relationships depicted and make it easier for viewers to understand the ownership hierarchy. You can also add annotations to highlight important relationships, risks, or other pertinent information relevant to the M&A transaction.

Step 6: Export, Share, and Collaborate

Export your company structure diagram in various formats, such as PDF, JPG, PNG, or SVG, for easy sharing and distribution. You can use Lexchart's built-in sharing features to share your diagram with stakeholders and team members involved in the M&A due diligence process. Lexchart's collaboration tools allow multiple users to work on the same diagram.

Leveraging Company Structure Diagrams for Effective M&A Due Diligence

Effective M&A due diligence requires a deep understanding of the companies involved, including their ownership structures. Company structure diagrams can provide valuable insights by visually representing complex relationships, revealing hidden risks, and identifying potential synergies.

By following the steps outlined in this article and using Lexchart, you can create informative and visually appealing company structure diagrams that support the due diligence process, facilitate informed decision-making, and promote successful M&A transactions.

Conclusion

Visualizing company structures is a vital aspect of M&A due diligence. Company structure diagrams created with Lexchart can help decision-makers navigate the complexities of mergers and acquisitions, enabling them to identify risks, evaluate synergies, and plan for successful integration. By leveraging the power of Lexchart and the insights gained from company structure diagrams, M&A professionals can make more informed decisions and improve the likelihood of a successful transaction.

Learn more about company structure charts with the Ultimate Guide to Company Structure Charts.