C Corporations

A Subchapter C Corporation (or C corp) is the most common business entity for large and publicly traded companies. This video explains the structure of C corps in about a minute.

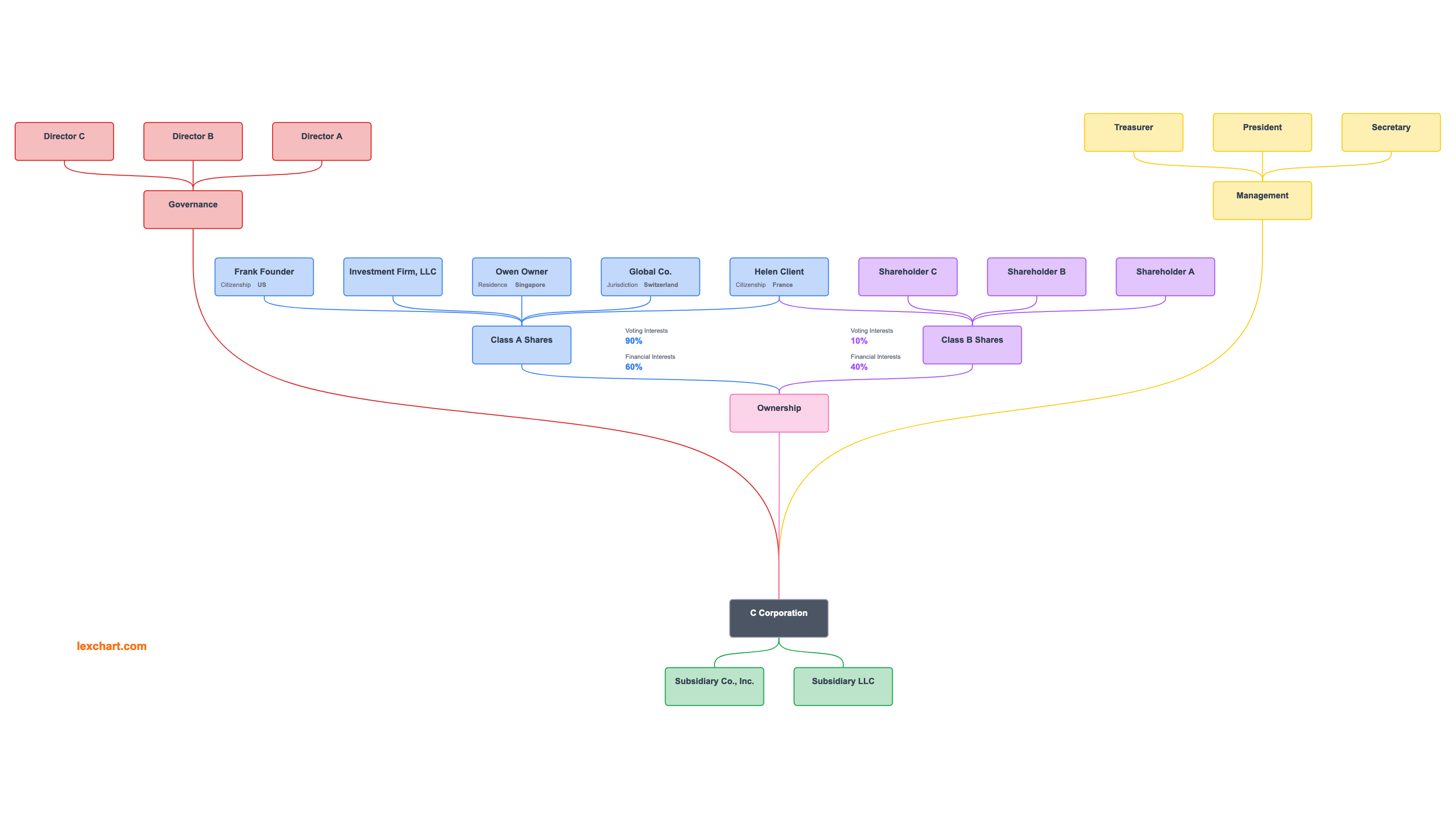

Ownership

A C corp may have multiple classes of stock. Class A shares and Class B shares may grant different voting and economic rights to a shareholder.

A C corp may have unlimited shareholders with no residency or citizenship requirements. Shareholders can be natural persons or legal entities.

Governance

Shareholders elect a board of directors to govern the business. Directors can be officers or shareholders of the company or they may be independent.

Management

The board of directors appoints officers. Officers manage the business. Officers traditionally include a president, treasurer, and secretary.

Subsidiaries

C corps can own any number of businesses in whole or in part. These are called subsidiaries.

Tax status

C corporations are subject to double taxation. Double taxation means that the corporation pays taxes on income it earns. Shareholders then pay taxes on their share of the profits that the corporation pays out as dividends.

This has been the structure of C corporations in about a minute.