Company structure

Company structure means your business can become a dynasty. Companies in Europe and Asia trace their origin back 500 and even 1,000 years. People own and operate businesses; structure protects and grows the work of those people. New businesses and old businesses use structure to improve the odds that they survive for generations.

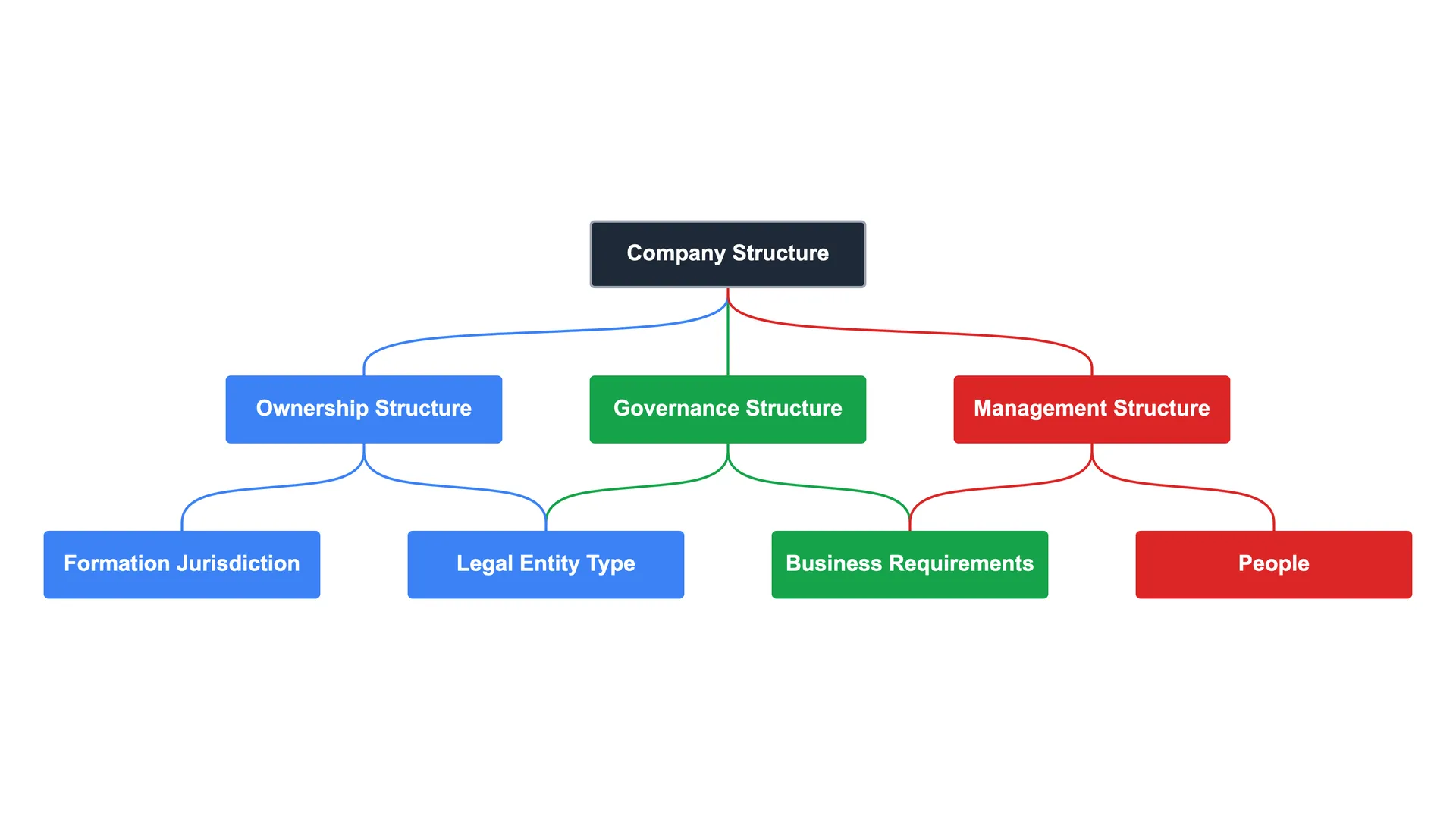

What does company structure mean?

Company structure means the roles and responsibilities related to the ownership, governance, and management of a business.

Ownership structure

Companies are formed in a place, a legal jurisdiction. In the United States companies are incorporated in one of the 50 states or the District of Columbia (Washington DC). The general rule around the world is that companies are formed at the national level. In Canada and Australia, businesses can be formed at both the national and regional levels of government.

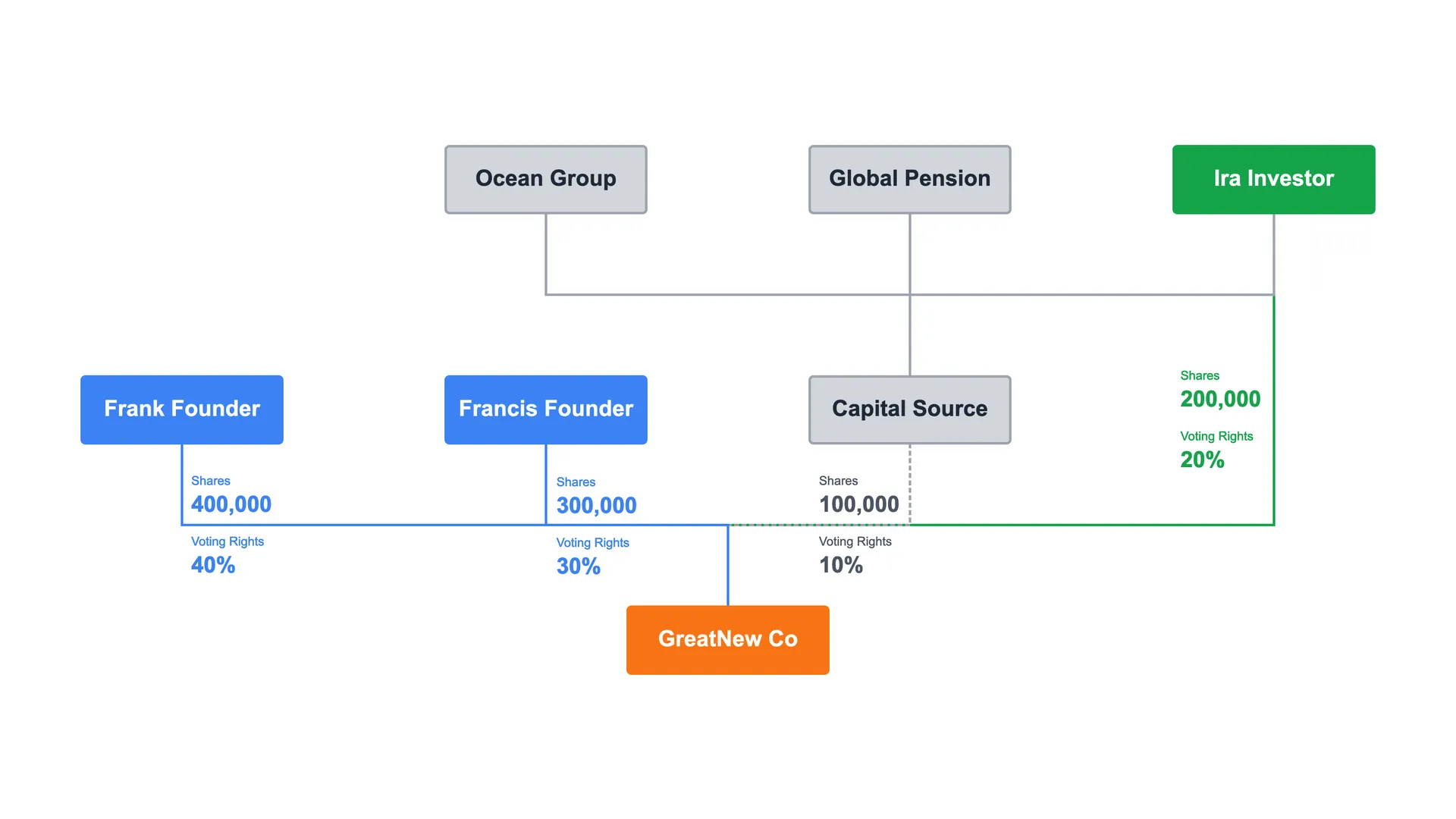

Owners can be individuals or other businesses. To complicate matters, an owner's rights to the business can be split between management and economic rights. Management rights refer to the ability to influence the appointment of officers. Economic rights include the right to receive proceeds of the business.

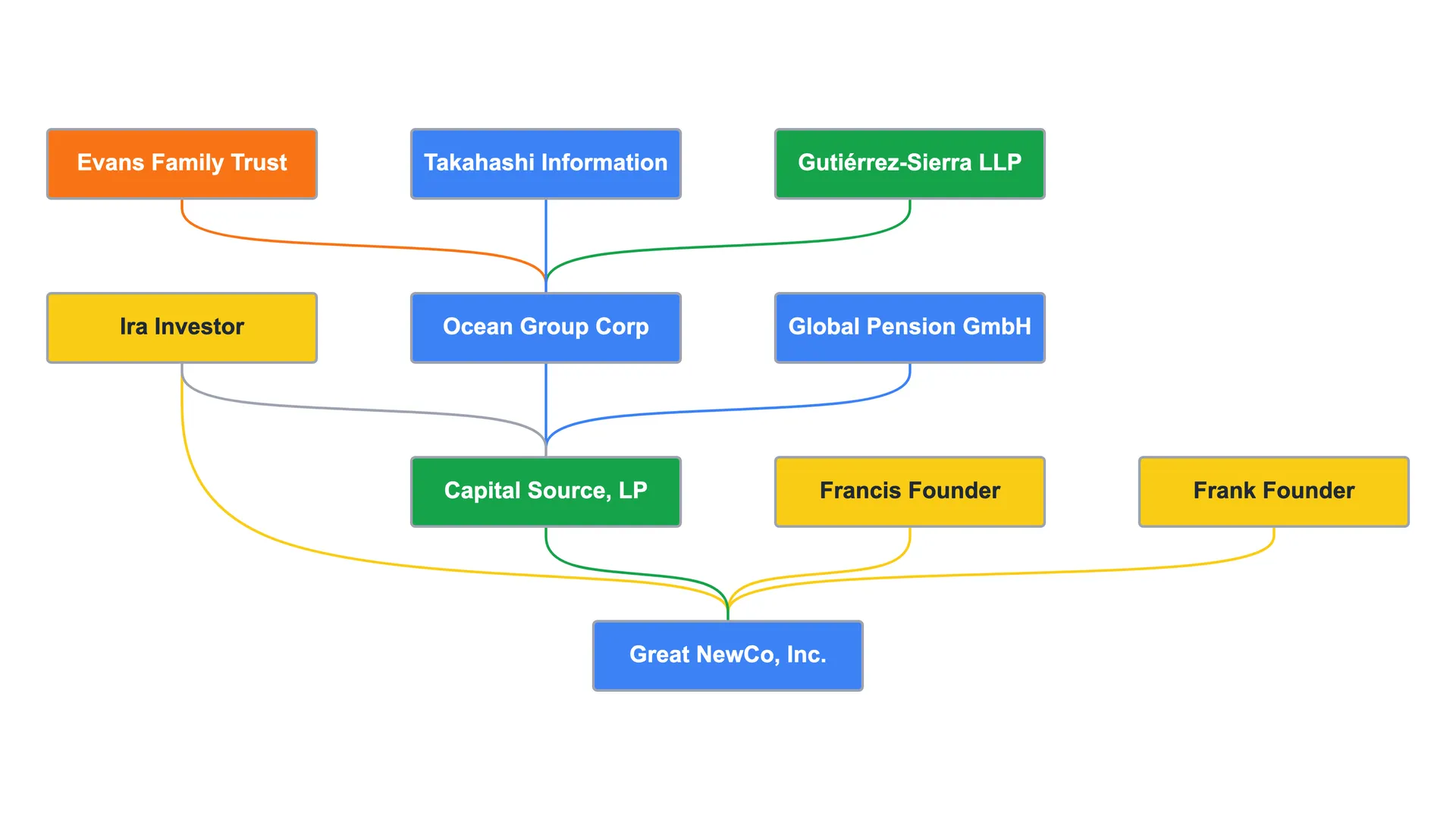

Note that ownership charts are hierarchical. The charts in this article are created with Lexchart. You can try it for free and there are example charts you can copy to get started.

Many businesses own other business. There are three levels of ownership in a corporate structure: parents, affiliates, and subsidiaries.

A parent owns a company. An affiliate is a company on the same organizational level as another entity, reflected on a company structure chart. A subsidiary is a company on a lower level of the company structure chart, owned by one or more entities on the chart.

Ownership structure implies that there is at least one legal entity. Many factors influence the decision founders make to create one type of legal entity or another. The factors include taxes, costs, capital structure, exit strategy, and more.

Later, I will cover examples of ownership structure for limited liability companies, corporations, and partnerships.

Governance structure

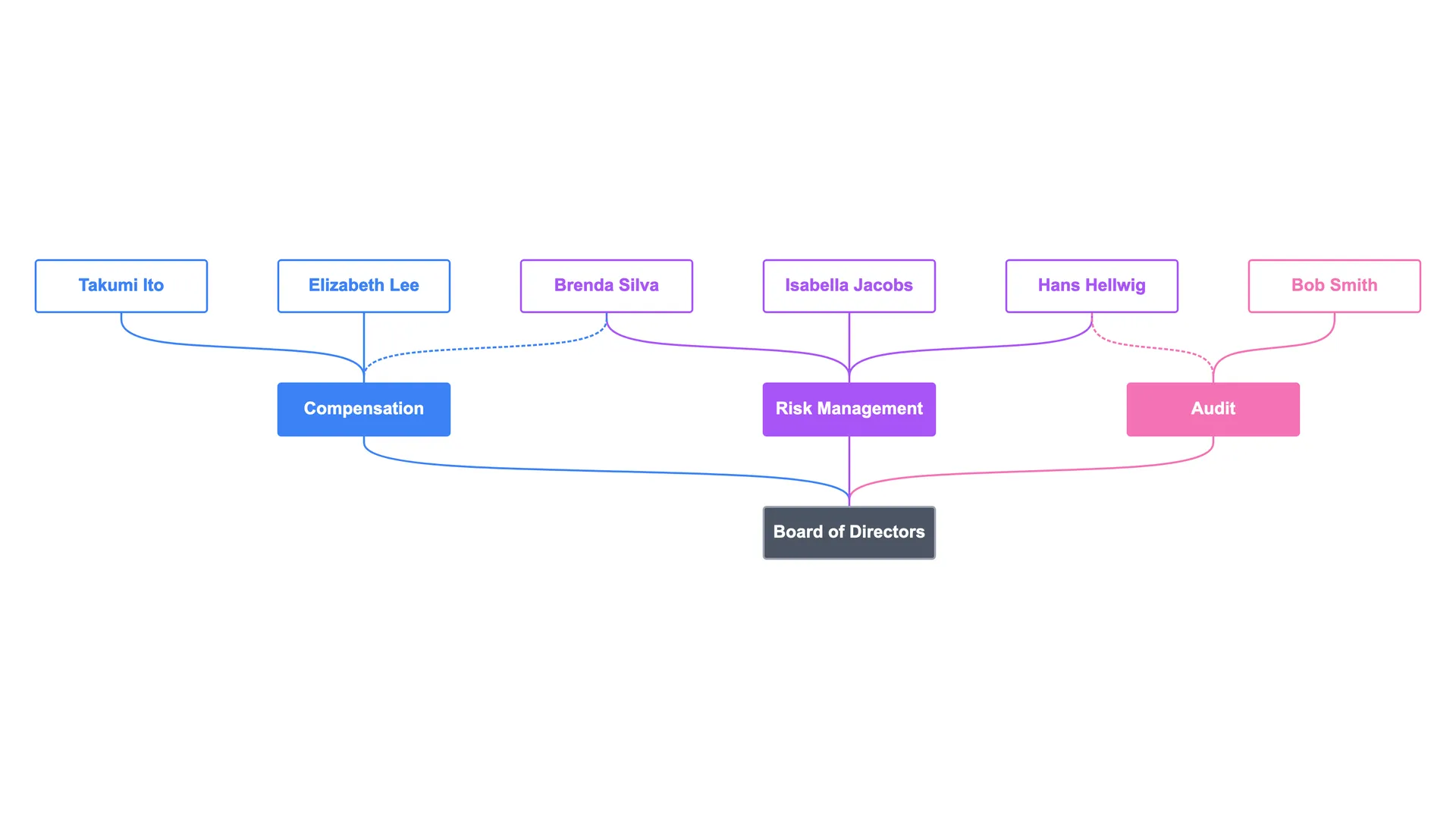

Companies can have a governance structure. A governance chart depicts the board of directors for a legal entity. Governance can include committees, standing or special purpose, within the board of directors. A governance chart should show the board, committees, and individual member assignments.

Factors like jurisdiction, industry, and legal entity type shape the governance structure for a company. Companies might need, for example, both governing and advisory boards.

The by-laws and organizational documents for the legal entity impose another layer of requirements on the governance structure.

Management structure

Management structure refers to the organization of people operating the business. Management structure can be shown in an organizational chart.

Management structure can have a narrow meaning. In a legal sense, management refers to the named officers of the legal entity. Named officers include the president, treasurer, and secretary. The list of named officers can vary by jurisdiction and legal entity type.

In the broadest sense, management structure refers to the reporting relationships of staff who run the business. That structure might refer to job titles and functions and/or people.

This table shows ownership, governance, and management structure terms by type of legal entity:

| Structure | Owners | Governance | Managers |

|---|---|---|---|

| C Corporation | Shareholders | Directors | Officers |

| S Corporation | Shareholders | Directors | Officers |

| Limited Liability Company | Members | Members* | Managers |

| General Partnership | Partners | Partners | Partners |

| Limited Partnership | Limited Partners | Partners | General Partner |

* LLCs backed by professional investors use corporation-like governance structures and terminology. You can read about the differences between types of organization charts.

What are the types of company structures?

There are many types of legal entities. The decision about which type to choose for your business is complex and specific to each business. See the 9 Principles of Legal Entities.

I will focus on three major types of legal entities: LLCs, corporations, and partnerships. Many countries and all US states have a version of these business types. Each entity has sub classifications which show up in our company structure.

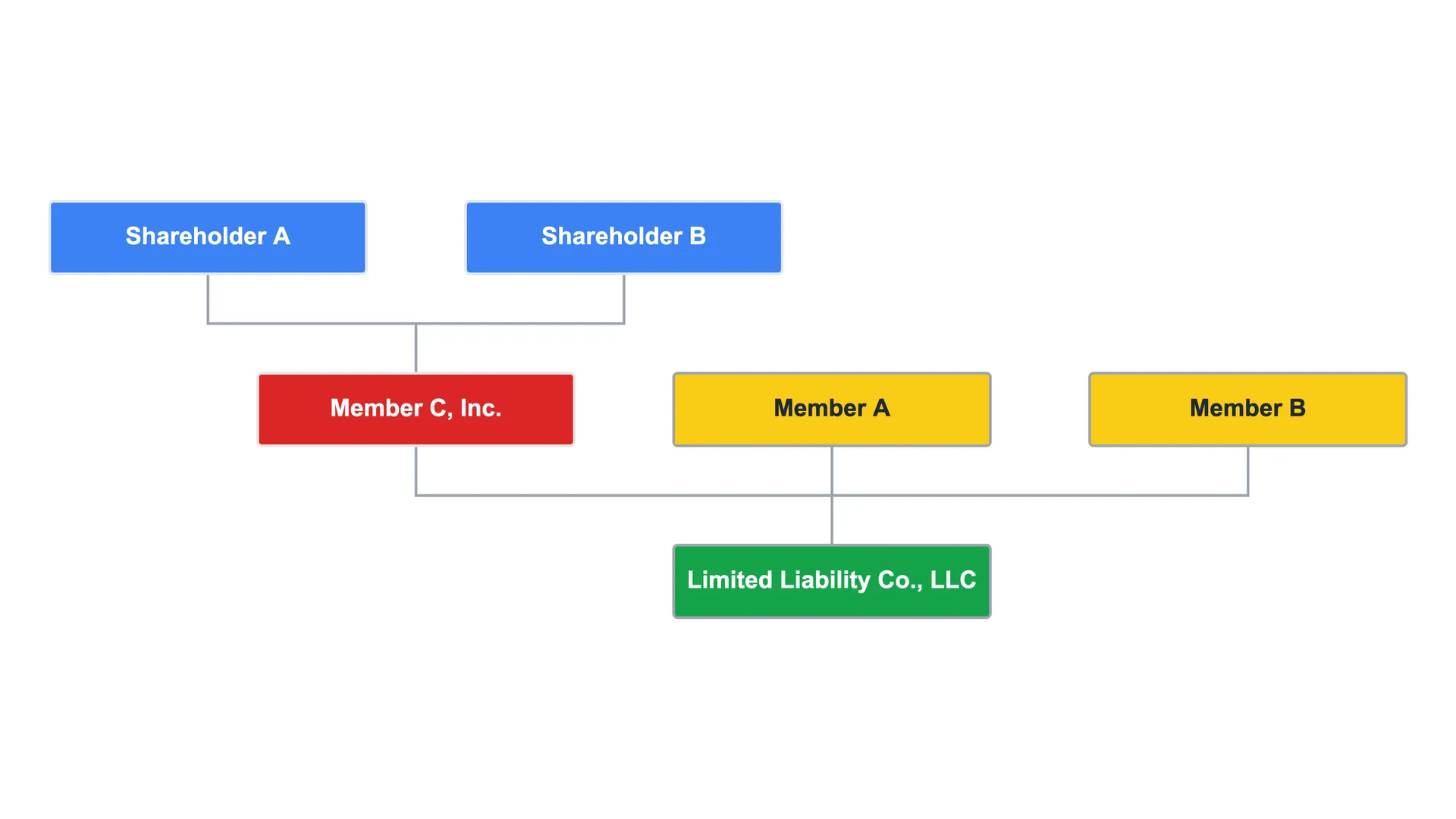

LLC company structure

A limited liability company (LLC) is a type of legal entity created by state law. Most states have adopted a form of the Uniform Limited Liability Company Act. The LLC is the most popular legal entity to incorporate for new businesses. LLCs blend the liability protection of corporations and the pass-through tax status of partnerships.

Here are the major types of LLCs:

| Type of LLC | Liability Protection | Tax Status | Owner-Manager Separation |

|---|---|---|---|

| Member Managed | Entity | Pass through | Combined |

| Manager Managed | Entity | Pass through | Separate |

| Professional LLC | Limited | Pass through | Varies |

LLC Ownership Structure

The LLC is a flexible legal form. LLC owners and investors are called "Members." Ownership interests are called "Membership Interests." There are exceptions because LLC statutes are flexible. LLCs might separate types of ownership interest like voting interests (rights to participate in decisions) and financial interests (rights to receive distributions).

Smaller LLCs use the Member Managed form where the members run the business as officers. Manager Managed LLCs separate oversight by owners (members) and operations (managers).

LLCs can opt to be taxed like a corporation with entity level taxation, but this is not typical. Some states authorize a master LLC form called a Series LLCs.

LLC Governance Structure

Many LLCs adopt the nomenclature of corporations, such as a Board of Directors and officers. When an LLC structure uses a Board of Directors the company structure chart might include the following information about each director:

- Type of Role: officer, director, or other (consultant, lawyer, accountant, or auditor)

- Title: chair, director, President and CEO, Treasurer, Secretary, etc.

- Name: first and last name

- Start Date (term of service): date appointment starts

- End Date (term of service): date appointment ends

Please note that a person can have two different roles with different terms of service.

Corporate structure

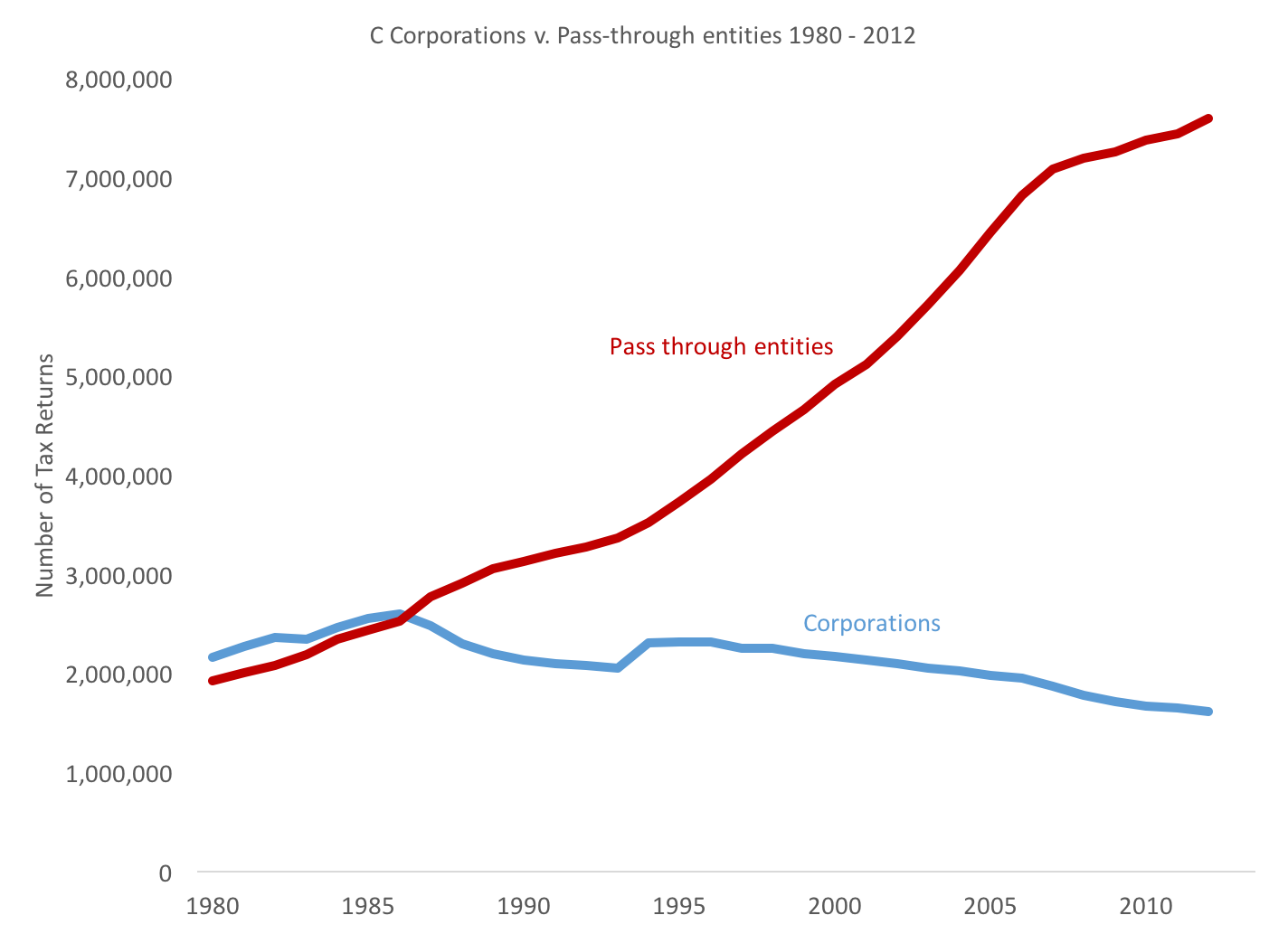

The Corporation is the legal form of a business that is at the heart of modern business law. The corporate form is not popular for new businesses. Most large companies use the corporation.

The corporate form is flexible. These are five of the more common types of corporations from a tax code perspective:

| Corporation Type | Liability Protection | Tax Status |

|---|---|---|

| C Corporation | Entity | Taxable |

| S Corporation | Entity | Pass through |

| Non-Profit | Entity | N/A |

| Benefit Corporation | Entity | Taxable |

| Professional Corporation | Limited | Taxable |

Non-Profits are typically organized under 501(c)(3) of the Internal Revenue Code for tax purposes. There are many other types of non-profit tax registrations.

The Professional Corporation designation is not a product of the tax code. It is a creature of state law. Not all states authorize Professional Corporations.

Ownership structure

Corporate owners and investors are called "Shareholders" or "Stockholders". Ownership interests are called "stocks" or "shares". There are several other instruments which convey ownership interests such as options, warrants, and convertible debt.

Governance structure

The Board of Directors for a corporation represents the shareholders in oversight of management. There are several ways to represent governance structure.

Partnerships

Generally, partnerships are unincorporated business entities. There are several forms of partnership governed both by common law and statutes described in this table:

| Partnership Type | Abbreviation | Liability |

|---|---|---|

| General Partnership | GP | All Partners |

| Limited Partnership | LP | Only General Partner |

| Limited Liability Partnership | LLP | Limited, like LLC |

| Limited Liability Limited Partnership | LLLP | General Partner has limited liability |

The LLLP (or "triple LP") is much less common than other forms of partnership. Partnerships benefit from pass through tax status.

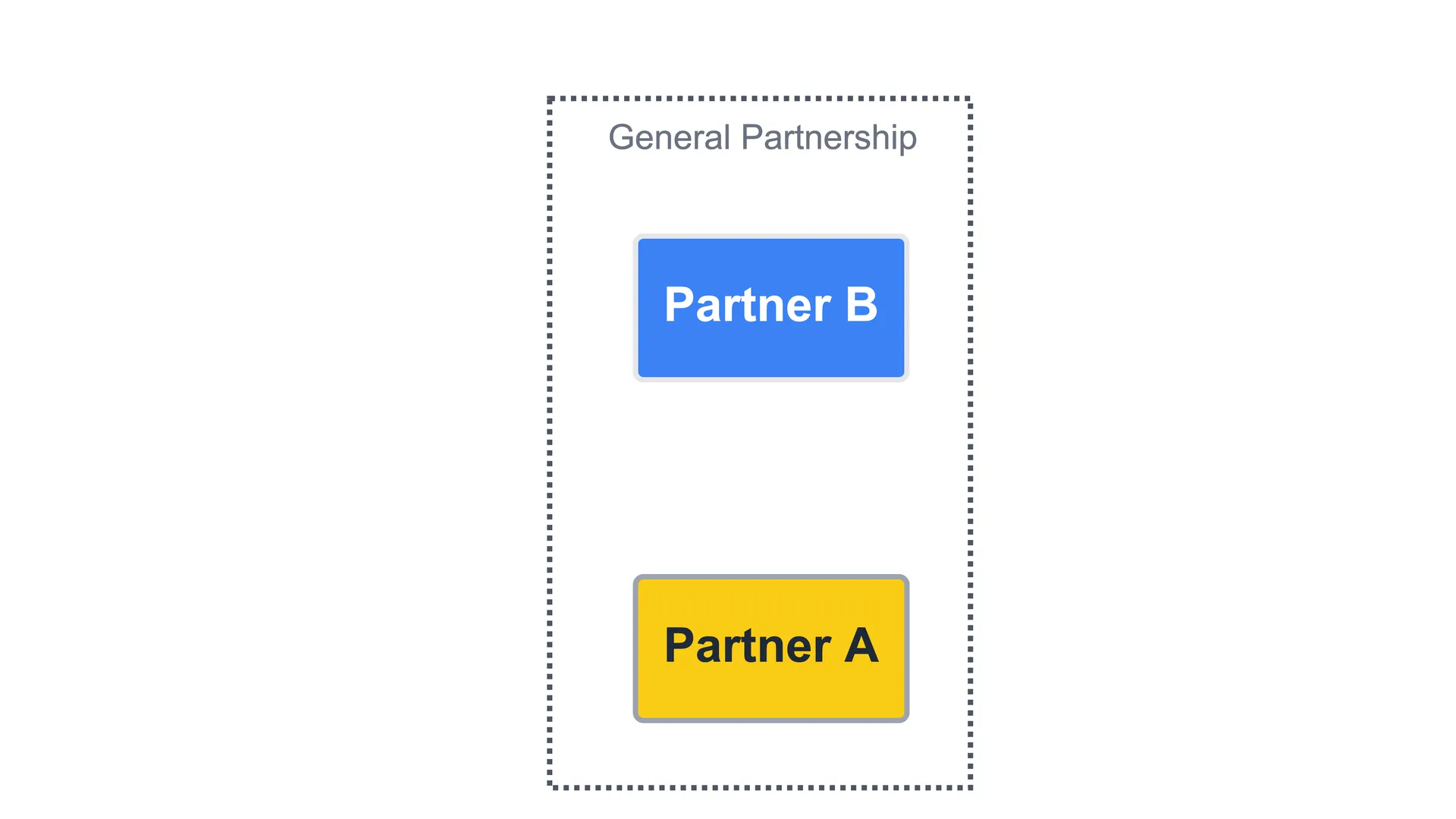

A General Partnership structure might look something like this:

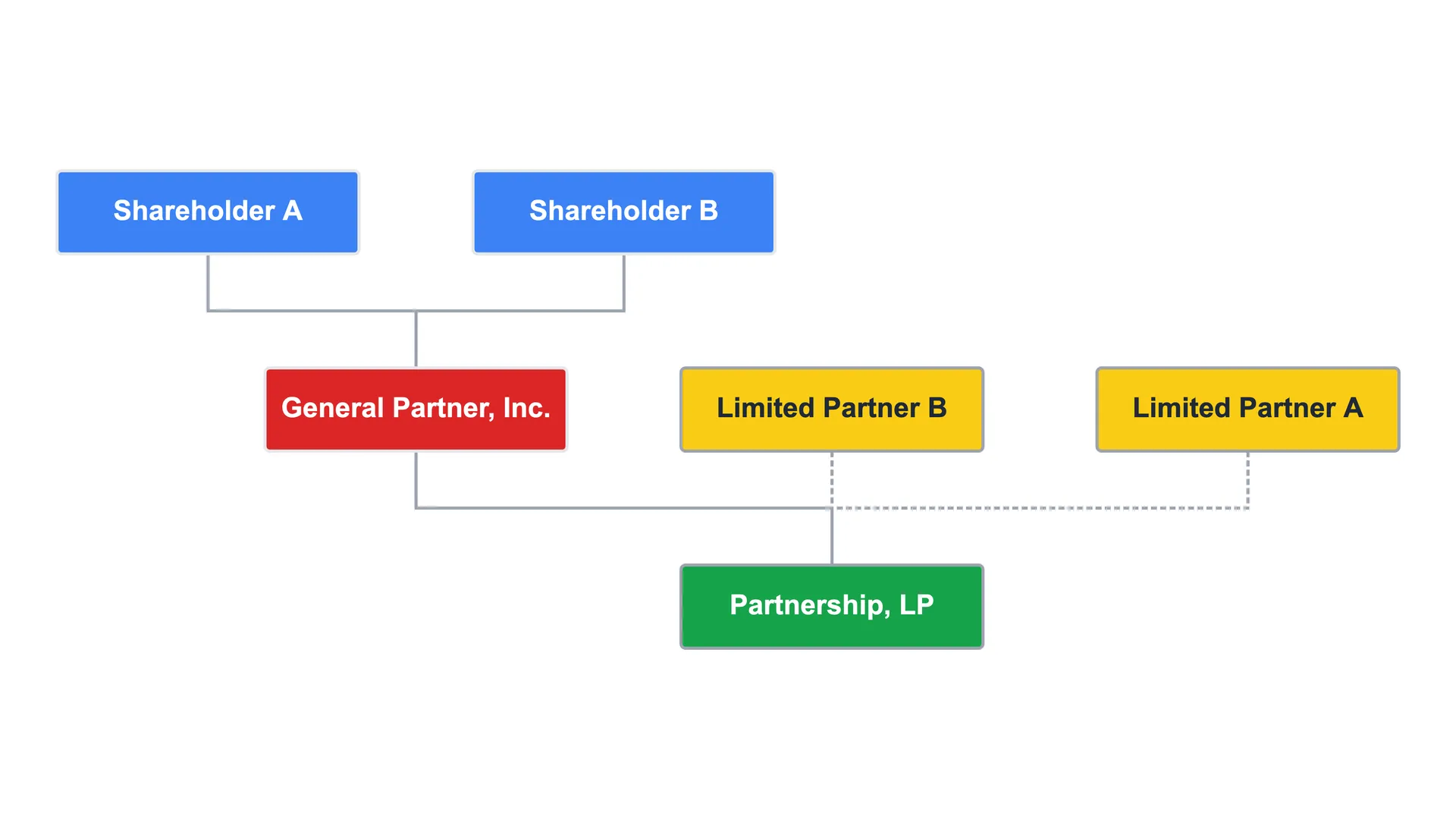

Limited partnerships commonly used for real estate investment vehicles resemble this structure in a simplified way:

Conclusion: the best company structure

The objectives of the business are critical to design an effective company structure. A US corporation which wants to enter the Argentinian market will need to form an Argentinian legal entity. It will have to make choices about management and ownership under local law. Those choices will also influence the results of the business back in the US.

An LLC creates a subsidiary that it plans to take public. Initial Public Offerings (IPOs) are typically accomplished by selling stock in corporations. The parent LLC forms the new entity as a C corporation.

Corporate structuring can enhance the value of any business. It is important to consider the legal form, the governing jurisdictions, type of ownership, and business objectives.

The best corporate structure is the one where you can see how it meets your needs.