Company Structure Charts: A Visual Guide to Private Equity Investments

Private equity investments are complex financial transactions involving multiple entities and legal structures. This complexity can make it difficult to understand the relationships between the various parties involved in a private equity investment. Company structure charts are a useful tool for visualizing these relationships and understanding how different entities are connected in a private equity investment.

Basic Structure of a Private Equity Investment

The basic structure of a private equity investment typically involves a private equity fund managed by a general partner. The general partner raises capital from limited partners and invests that capital in various companies or assets. The limited partners are passive investors who provide the capital for the fund but do not have a direct role in managing the investments.

This chart is derived from this table (spreadsheet) of relationships between legal entities, the private equity fund, and partners:

| Parent | Child | Parent Role | Child Role |

|---|---|---|---|

| Global Equity Group | Equity Fund I | General Partner | Private Equity Fund |

| Equity Fund I | Tech Innovators Inc. | Private Equity Fund | Investment |

| Equity Fund I | Healthcare Growth LLC | Private Equity Fund | Investment |

| Equity Fund I | Real Estate Holdings LP | Private Equity Fund | Investment |

| Limited Partners | Equity Fund I | ||

| Sally Jones | Limited Partners | Limited Partner | |

| Juan Suarez | Limited Partners | Limited Partner | |

| Henry Xi | Limited Partners | Limited Partner |

In this example, the Global Equity Group is the general partner that manages Equity Fund I. The fund invests in three companies: Tech Innovators Inc., Healthcare Growth LLC, and Real Estate Holdings LP. The limited partners, Sally Jones, Juan Suarez, and Henry Xi, provide the capital for the fund but do not have a direct role in managing the investments.

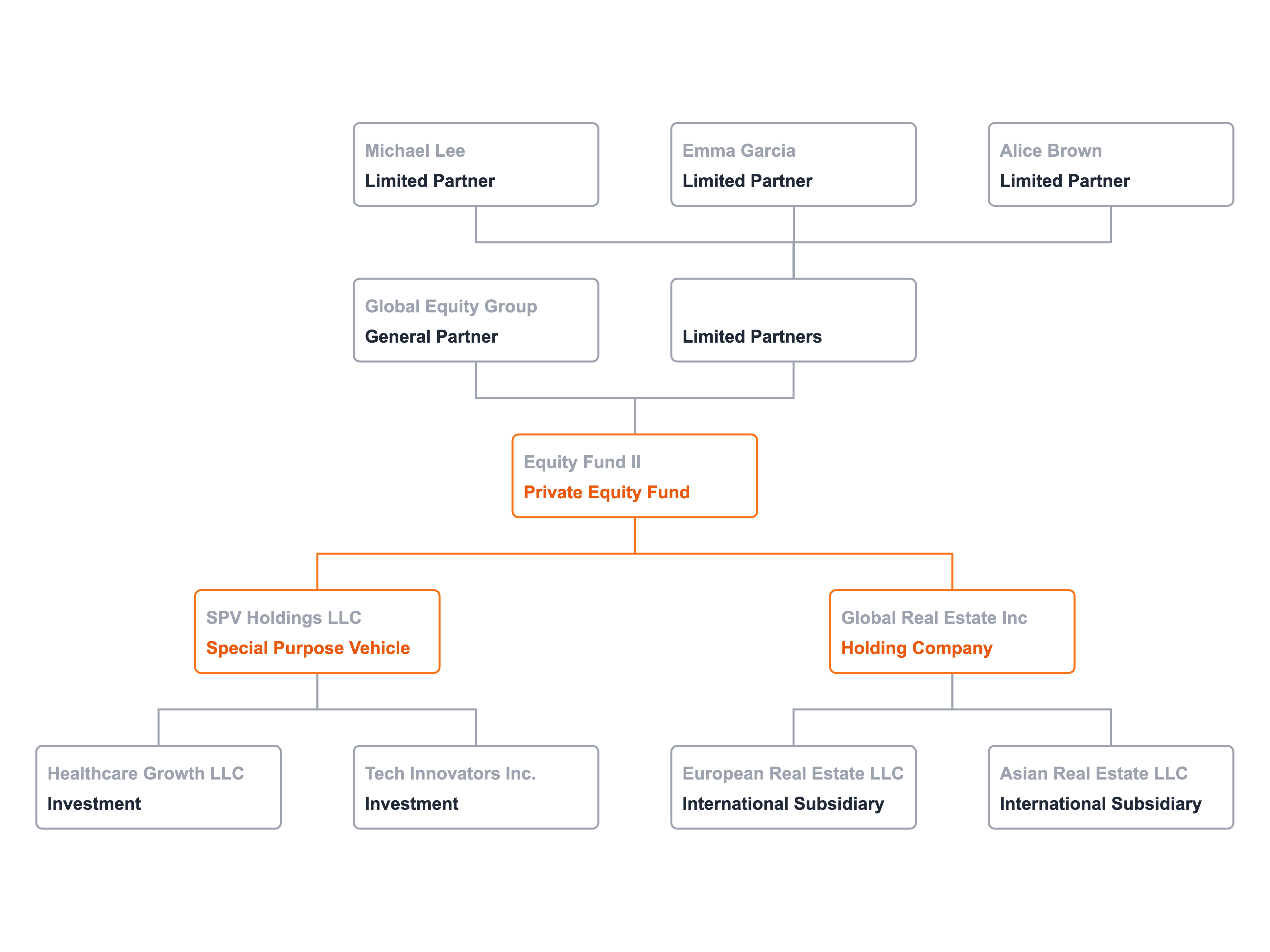

Advanced Structure of a Private Equity Investment

In more complex private equity investments, the fund may use special purpose vehicles (SPVs) or holding companies to structure its investments. SPVs are separate legal entities created to hold specific assets or investments, while holding companies are entities that own and control other companies or assets. These structures can help to manage risk, optimize tax efficiency, and provide flexibility in structuring investments.

This chart is derived from this table (spreadsheet) of relationships between legal entities, the private equity fund, and partners:

| Parent | Child | Parent Role | Child Role |

|---|---|---|---|

| Global Equity Group | Equity Fund II | General Partner | Private Equity Fund |

| Equity Fund II | SPV Holdings LLC | Private Equity Fund | Special Purpose Vehicle |

| SPV Holdings LLC | Tech Innovators Inc. | Special Purpose Vehicle | Investment |

| SPV Holdings LLC | Healthcare Growth LLC | Special Purpose Vehicle | Investment |

| Equity Fund II | Global Real Estate LP | Private Equity Fund | Holding Company |

| Global Real Estate Inc. | European Real Estate LLC | Holding Company | International Subsidiary |

| Global Real Estate Inc. | Asian Real Estate LLC | Holding Company | International Subsidiary |

| Limited Partners | Equity Fund II | Private Equity Fund | |

| Alice Brown | Limited Partners | Limited Partner | |

| Michael Lee | Limited Partners | Limited Partner | |

| Emma Garcia | Limited Partners | Limited Partner |

In this example, the Global Equity Group is the general partner that manages Equity Fund II. The fund uses SPV Holdings LLC to hold its investments in Tech Innovators Inc. and Healthcare Growth LLC. It also uses Global Real Estate LP as a holding company to own and control its investments in European Real Estate LLC and Asian Real Estate LLC. The limited partners, Alice Brown, Michael Lee, and Emma Garcia, provide the capital for the fund but do not have a direct role in managing the investments.

Complex Structure of a Private Equity Investment

In complex private equity investments, the fund may have multiple layers of entities and investments, including international subsidiaries and joint ventures. These structures can involve a mix of equity, debt, and other financial instruments, as well as complex legal agreements and tax considerations. Understanding the relationships between these entities and investments is essential for managing risk and maximizing returns in a private equity investment.

This chart is derived from this table (spreadsheet) of relationships between legal entities, the private equity fund, and partners:

| Parent | Child | Parent Role | Child Role |

|---|---|---|---|

| Global Equity Partners | Equity Fund III | General Partner | Private Equity Fund |

| Equity Fund III | SPV Holdings I LLC | Private Equity Fund | Special Purpose Vehicle |

| SPV Holdings I LLC | North American Tech Inc. | Special Purpose Vehicle | Investment |

| SPV Holdings I LLC | European Health Corp. | Special Purpose Vehicle | Investment |

| Equity Fund III | Global Infrastructure Inc. | Private Equity Fund | Holding Company |

| Global Infrastructure Inc. | Asian Infrastructure LLC | Holding Company | International Subsidiary |

| Global Infrastructure Inc. | Latin American Real Estate LLC | Holding Company | Special Purpose Vehicle |

| Asian Infrastructure LLC | India Renewable Energy Ltd. | International Subsidiary | Investment |

| Asian Infrastructure LLC | China Transport Inc. | International Subsidiary | Investment |

| Equity Fund III | SPV Holdings II LLC | Private Equity Fund | Special Purpose Vehicle |

| SPV Holdings II LLC | Latin American Real Estate LLC | Special Purpose Vehicle | Special Purpose Vehicle |

| Limited Partners | Equity Fund III | Private Equity Fund | |

| Jane Doe | Limited Partners | Limited Partner | |

| John Smith | Limited Partners | Limited Partner | |

| Chris Johnson | Limited Partners | Limited Partner |

In this example, Global Equity Partners is the general partner that manages Equity Fund III. The fund uses SPV Holdings I LLC to hold its investments in North American Tech Inc. and European Health Corp. It also uses Global Infrastructure LP as a holding company to own and control its investments in Asian Infrastructure LLC and Latin American Real Estate LLC. The Asian Infrastructure LLC owns India Renewable Energy Ltd. and China Transport Inc. as international subsidiaries. SPV Holdings II LLC is a special purpose vehicle that holds additional investments in Latin American Real Estate LLC. The limited partners, Jane Doe, John Smith, and Chris Johnson, provide the capital for the fund but do not have a direct role in managing the investments.

Benefits of Using Company Structure Charts

Company structure charts are a valuable tool for visualizing the relationships between the various entities and investments in a private equity investment. They can help investors, fund managers, and other stakeholders understand the complex legal and financial structures involved in a private equity investment. By providing a clear and concise visual representation of these relationships, company structure charts can help identify potential risks, optimize tax efficiency, and support informed investment decisions.

Conclusion

Company structure charts are essential for understanding the relationships between the various entities and investments in a private equity investment. By visualizing these relationships, investors, fund managers, and other stakeholders can gain a better understanding of the complex legal and financial structures involved. This understanding can help manage risk, optimize tax efficiency, and make informed investment decisions. Company structure charts are a valuable resource for anyone involved in private equity investments, from limited partners to fund managers to legal advisors.

This chart is made with Lexchart for automatic organization charts.