How to Structure a Single Family Office

Introduction to the Single Family Office (SFO)

Definition of Single Family Office

A Single Family Office (SFO) is a private organization dedicated to managing the financial, legal, and administrative affairs of one high net-worth family. The primary objective of an SFO is to centralize the management of the family's wealth and provide tailored services to meet their specific needs and preferences.

Benefits of using an SFO

The benefits of using an SFO include a high level of personalization, privacy, control over investment decisions, and the ability to maintain a long-term focus on wealth preservation and growth. SFOs provide a dedicated team of professionals working exclusively for the family, ensuring that their unique financial goals are consistently addressed.

Structure of a Single Family Office

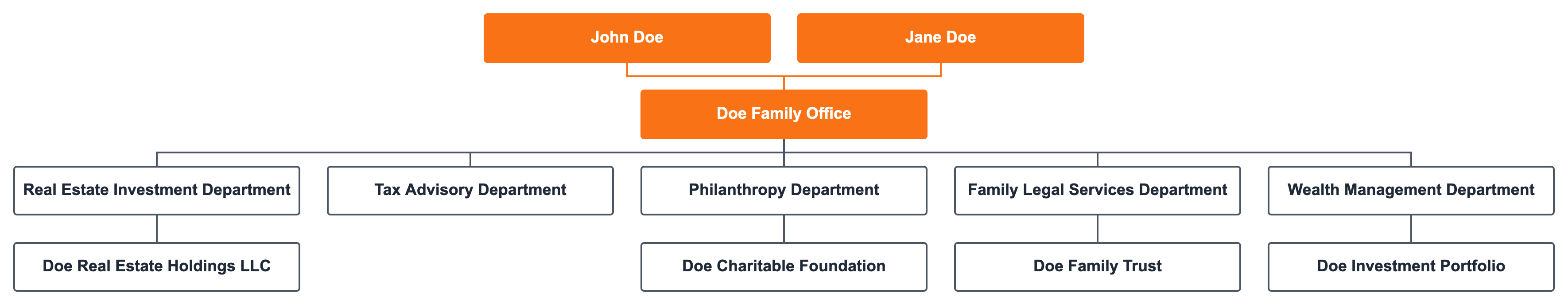

This is an example of a single family office structure. There are many potential permutations and variations.

Overview of the Single Family Office structure

The Doe Family Office serves the high net-worth Doe family, consisting of John and Jane Doe. The SFO structure comprises various subsidiaries and departments that manage different aspects of the family's financial affairs, such as wealth management, legal services, real estate investments, tax advisory, and philanthropy.

Connections between the family and the SFO

John and Jane Doe, as the high net-worth individuals, are directly connected to the Doe Family Office, which serves as the central point for coordinating and managing the various financial services on behalf of the family. This connection allows the SFO to tailor its services to the family's needs and ensure that their specific financial goals are addressed.

Family Members

John Doe

John Doe is a high net-worth individual who has established the Doe Family Office to manage his wealth and investments. By creating an SFO, he can access a wide range of specialized services that cater to his unique financial needs.

Jane Doe

Jane Doe is also a high net-worth individual and a member of the Doe family. She benefits from the comprehensive and personalized services provided by the Doe Family Office and its dedicated team of professionals.

In-House Departments

Wealth Management Department

The Wealth Management Department is an in-house department of the Doe Family Office that provides investment management and financial planning services for the family. It is responsible for managing the Doe Investment Portfolio, ensuring that the family's wealth is managed according to their preferences and goals.

Family Legal Services Department

The Family Legal Services Department is another in-house department of the Doe Family Office, responsible for providing legal support and services to the family. It manages the Doe Family Trust, ensuring that the trust receives specialized legal advice and guidance.

Real Estate Investment Department

The Real Estate Investment Department is a department of the Doe Family Office that manages the family's real estate investments. It is responsible for the Doe Real Estate Holdings LLC, providing dedicated management and investment support for the family's real estate assets.

Tax Advisory Department

The Tax Advisory Department is an in-house department of the Doe Family Office, responsible for providing tax planning and advisory services to the family. This department ensures that the family's financial affairs are managed efficiently from a tax perspective.

Philanthropy Department

The Philanthropy Department is a department within the Doe Family Office that focuses on the family's philanthropic endeavors and manages their charitable foundation. This department helps the family develop and implement their philanthropic strategies, ensuring that their charitable goals are met.

Family Trust

Purpose of the Doe Family Trust

The Doe Family Trust is a legal arrangement created by John and Jane Doe to manage, protect, and distribute their assets according to the terms set by them. The trust holds various assets, such as investments and real estate, and is used for estate planning, tax planning, and wealth preservation purposes.

Connection between the Trust and the Family Legal Services Department

The Family Legal Services Department is directly connected to the Doe Family Trust, providing legal advice and guidance to the trust. This connection ensures that the trust is managed according to the family's wishes and in compliance with the relevant laws and regulations.

Real Estate Holdings

Purpose of Doe Real Estate Holdings LLC

Doe Real Estate Holdings LLC is an entity that holds and manages the real estate assets of the Doe family. Its primary objective is to preserve and grow the family's real estate investments while providing a steady stream of income.

Connection between Doe Real Estate Holdings LLC and the Real Estate Investment Department

The Real Estate Investment Department is directly connected to Doe Real Estate Holdings LLC, providing dedicated management and investment support for the family's real estate portfolio. This connection ensures that the family's real estate assets are managed efficiently and in line with their investment goals.

Investment Portfolio

Purpose of the Doe Investment Portfolio

The Doe Investment Portfolio is a collection of financial assets, such as stocks, bonds, and other securities, managed by the Wealth Management Department on behalf of the Doe family. The primary objective of the portfolio is to preserve and grow the family's wealth over the long term.

Connection between the Investment Portfolio and the Wealth Management Department

The Wealth Management Department is directly connected to the Doe Investment Portfolio, providing investment management and financial planning services for the family. This connection ensures that the family's investments are managed according to their preferences and financial goals.

Charitable Foundation

Purpose of the Doe Charitable Foundation

The Doe Charitable Foundation is a non-profit organization established by the Doe family to support their philanthropic endeavors. The foundation's primary objective is to make a positive impact on the causes and communities that the family is passionate about.

Connection between the Charitable Foundation and the Philanthropy Department

The Philanthropy Department is directly connected to the Doe Charitable Foundation, providing strategic guidance and support for the family's charitable giving. This connection ensures that the foundation's resources are used effectively and aligned with the family's philanthropic goals.

Conclusion

The Doe Single Family Office (SFO) structure is designed to provide comprehensive and personalized financial, legal, and administrative services to the high net-worth Doe family. The SFO connects the family to various in-house departments that manage different aspects of their financial affairs, such as wealth management, legal services, real estate investments, tax advisory, and philanthropy.

By utilizing the services of an SFO, the Doe family can benefit from a high level of personalization, privacy, and control over their wealth management, allowing them to focus on preserving and growing their wealth for future generations.

Learn more about company structure charts with the Ultimate Guide to Company Structure Charts.

This chart is made with Lexchart for automatic organization charts.