Are You a Beneficial Owner under the Corporate Transparency Act? [Probably]

![Are You a Beneficial Owner under the Corporate Transparency Act? [Probably]](/content/images/2024/02/beneficial-owner-thumbnail.png)

The Corporate Transparency Act requires that certain companies file Beneficial Ownership Information reports with the Financial Crimes Enforcement Network.

Who is a Beneficial Owner under the Corporate Transparency Act?

FinCEN is part of the Department of Treasury.

The Corporate Transparency Act really targets small businesses with less than $5 million in revenue or fewer than 20 employees.

Reporting Companies Have Beneficial Owners

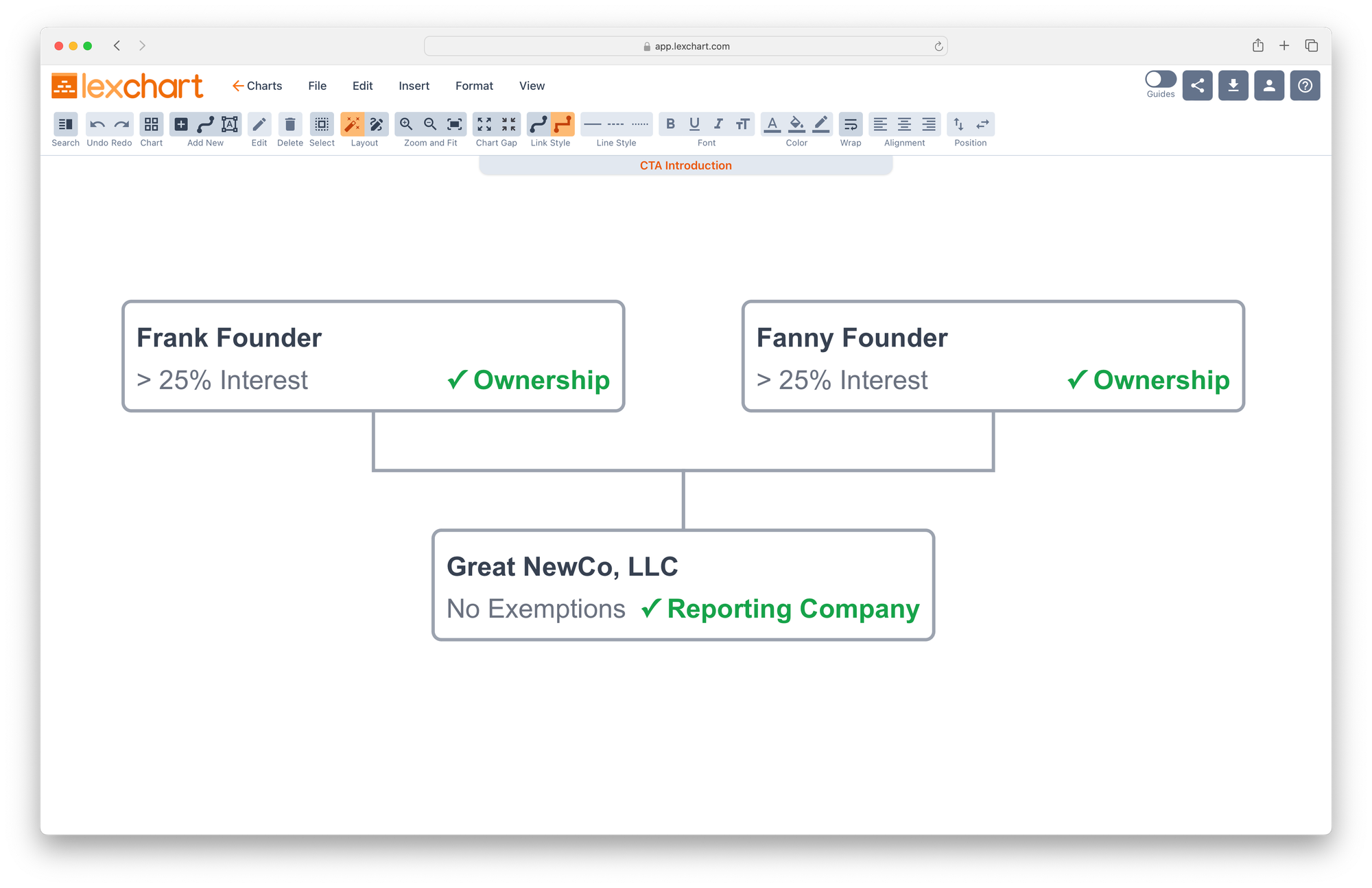

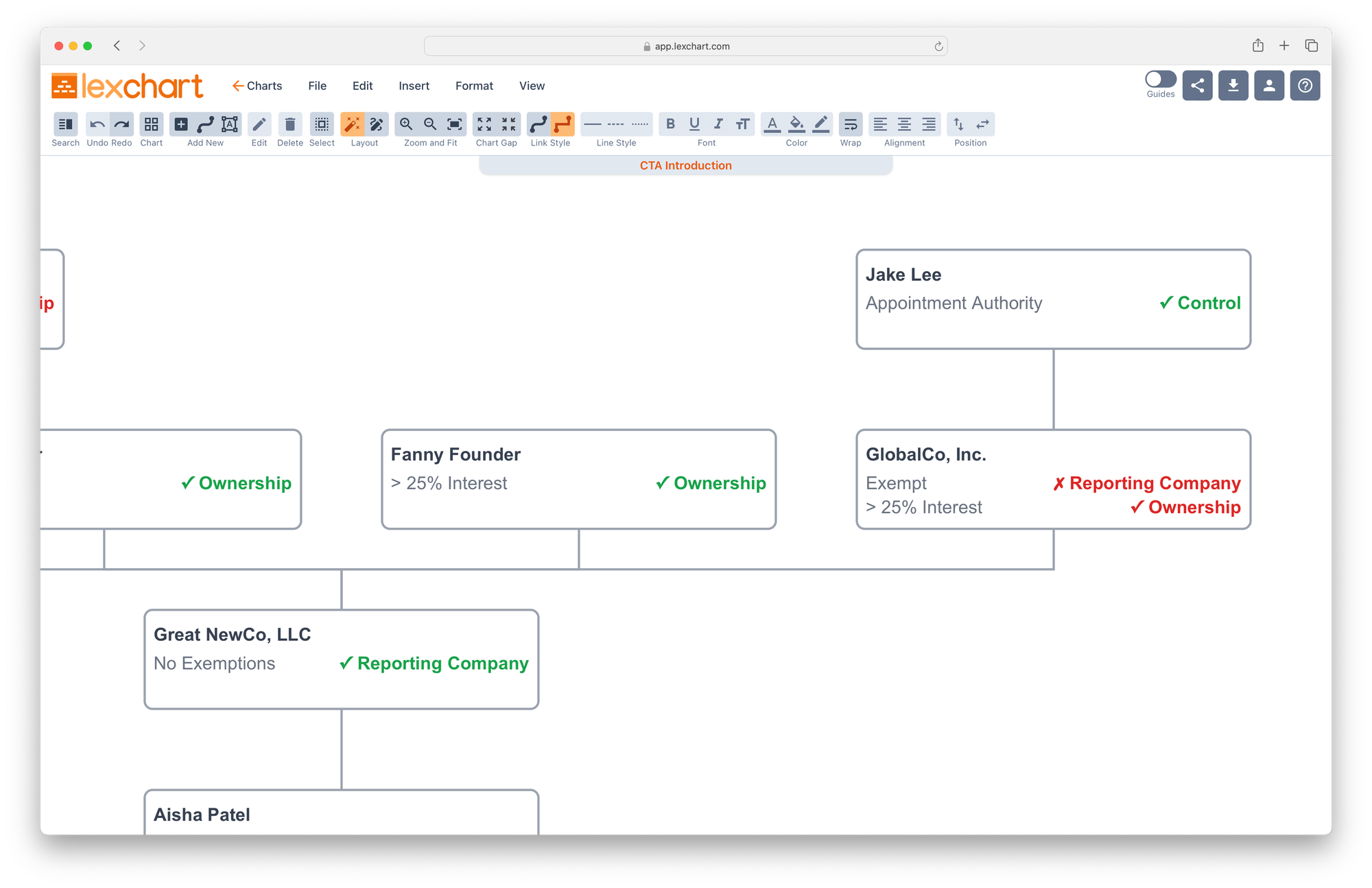

So let's assume that Great NewCo LLC is a reporting company under those criteria.

Let's assume that it has two founders, Frank and Fanny Founder. This is a common situation.

They both are beneficial owners under the Corporate Transparency Act because they have more than 25% interest in Great NewCo LLC.

So they would need to be disclosed when Great NewCo files its BOI report.

Read about the Corporate Transparency Act in depth

Outside Investors Are Beneficial Owners

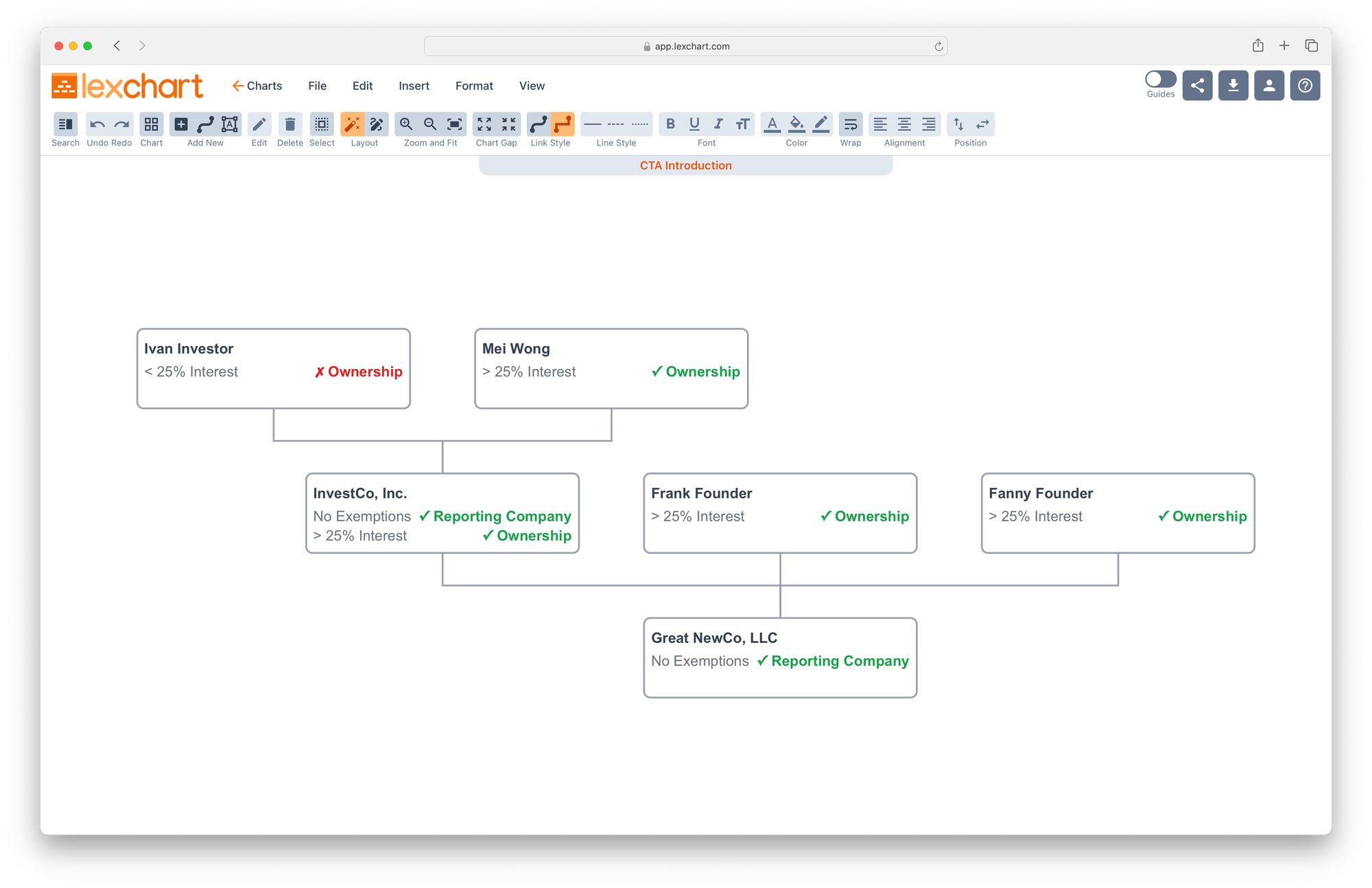

Let's assume that Frank and Fanny raised some outside money from InvestCo, Inc.

InvestCo, Inc. is itself a reporting company, no exemptions apply, and it has now more than 25% interest in Great NewCo.

So it is a beneficial owner that needs to be reported on Great NewCo's filing.

Now it might have to do its own filing, but we're just focused on Great NewCo for now.

The Corporate Transparency Act requires that we look further to see who owns and controls InvestCo because those people might be beneficial owners of Great NewCo through an indirect relationship.

Indirect Owners Are Beneficial Owners

So let's assume that Ivan Investor owns 25% of InvestCo and Mei Wong owns 75% of InvestCo.

So the question is, are either of them beneficial owners of Great NewCo through an indirect relationship?

If we assume that InvestCo owns 40% of Great NewCo, then Ivan would not be an owner because his indirect interest in Great NewCo is only 10%. 40% times 25% is 10%.

Mei's 75% gives her a 30% ownership interest in Great NewCo indirectly.

So 40% of InvestCo's ownership interest times Mei's 75% interest is 30%, which means she is a beneficial owner of Great NewCo solely through this indirect ownership test that's going to reach Mei.

And Great NewCo will need to list her, but not Ivan, as a beneficial owner.

InvestCo will have to list both of them as beneficial owners on its report.

But again, we're just focused on Great NewCo.

Senior Managers Are Beneficial Owners

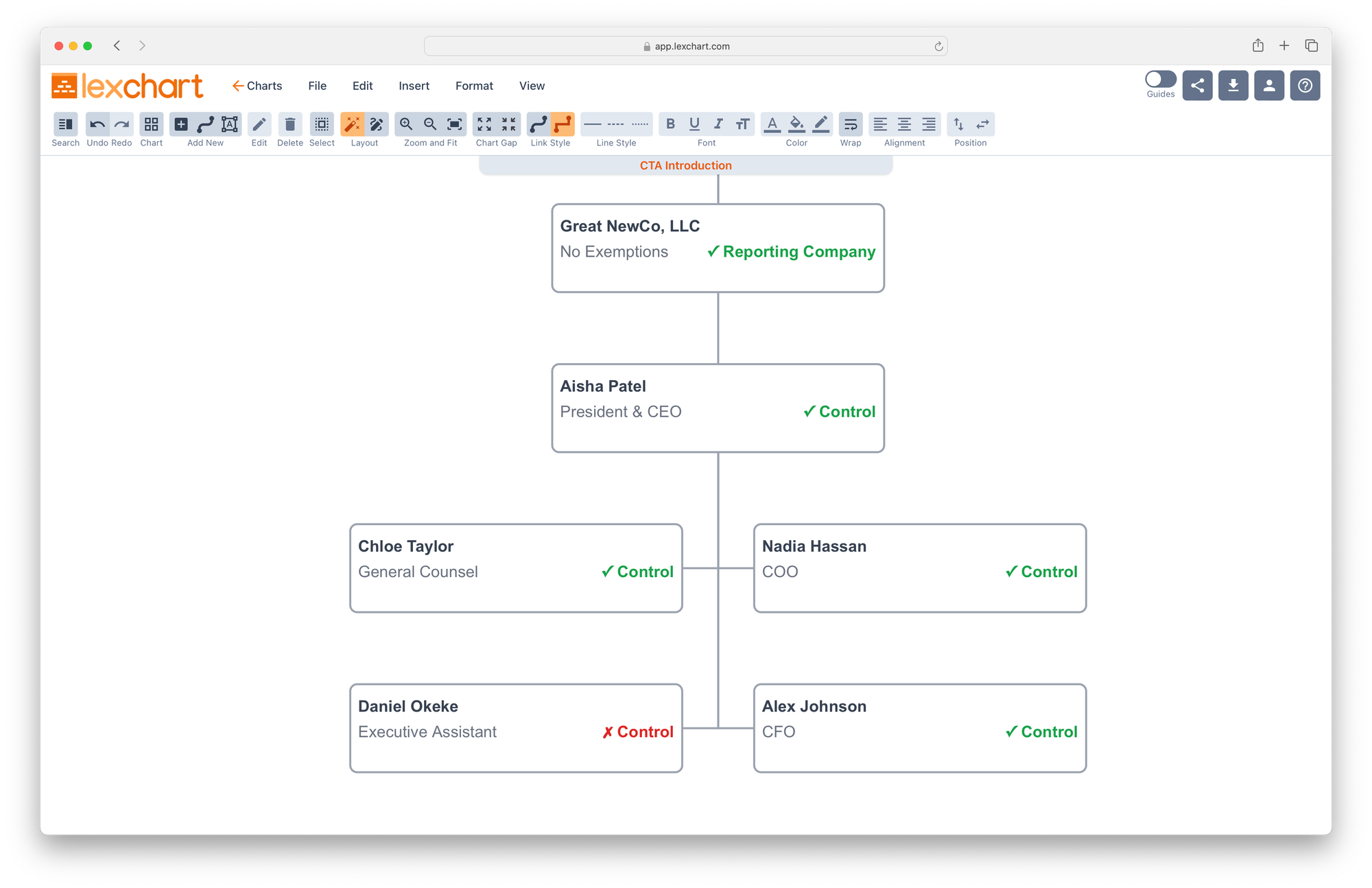

So the business grows and opens a new chapter.

They hire a CEO, Aisha.

Now the term beneficial owner in the Corporate Transparency Act is a bit misleading.

It's a lot more than just ownership.

It includes the concept of substantial control.

Any individual who has substantial control over an entity that is a reporting company is a beneficial owner, even if there's no ownership interest.

The Corporate Transparency Act explicitly says that anyone with the President or CEO title is going to have substantial control over that entity.

So that means Aisha gets listed as a beneficial owner, even though she has no ownership interest.

Let's assume that Aisha hires a team.

She brings on a COO, a Chief Operating Officer, a Chief Financial Officer, General Counsel, and even an Executive Assistant.

Even though those people report to her, the COO, the CFO, and General Counsel all have substantial control under the Corporate Transparency Act. So they will need to be disclosed as beneficial owners, again, even though there's no ownership interest per se, but because they have substantial control.

Daniel presumably would not be listed as a beneficial owner because as an Executive Assistant, while he is important, he does not have substantial control over important decisions that affect Great NewCo.

Aisha and the Executive Team, the Senior Management, all get reported as beneficial owners simply by virtue of their substantial control over Great NewCo.

Let's explore two more complications.

Exempt Companies Are Beneficial Owners

After the business grows, they decide to bring in yet another investor.

This is GlobalCo Inc. GlobalCo Inc. is an exempt company, so they are not a reporting company.

You can access a free, interactive version of this Beneficial Ownership under the Corporate Transparency Act chart that includes panning and zooming to explore the details.

They have more than $5 million in revenue and more than 20 employees.

However, because GlobalCo has more than 25% interest in Great NewCo now, it does get listed as a beneficial owner, but we get to stop there.

So we don't do the indirect ownership analysis that we did with InvestCo. because when you have an exempt company that gets listed as a beneficial owner, the Corporate Transparency Act says you get to stop and not report any further.

However, let's explore one more complication.

Substantial Control Makes Beneficial Owners

GlobalCo acquires the right to have a seat on the Board of Directors or to appoint officers and directors of Great NewCo as part of its investment, a very standard term under these circumstances, and it has someone on its payroll, Jake Lee, who is the designated person that has the ability to sit on that Board of Directors seat and exert that appointment authority, the ability to appoint or remove officers and directors of Great NewCo.

Jake Lee now is potentially a beneficial owner because he has that appointment authority, which is a kind of substantial control that the CTA says counts for Beneficial Ownership Information reporting.

So we don't report Jake because he's an owner or even a senior manager of GlobalCo, but his power to exert appointment authority may give rise to him being a beneficial owner of Great NewCo notwithstanding the indirect relationship that he has through the ownership stake with GlobalCo.

Conclusion

So those are a number of complications from the simple case to a more complicated one about how the CTA can affect your business as it grows.