How to structure an Outsourced Family Office

Introduction to Outsourced Family Office (OFO)

Definition of Outsourced Family Office

An Outsourced Family Office (OFO) is a professional organization that provides comprehensive financial and wealth management services to high net-worth families by leveraging external expertise and resources. In an OFO structure, the family office outsources various aspects of financial management to specialized service providers, allowing families to access a wide range of expertise while maintaining cost efficiency.

Benefits of using an OFO

The benefits of using an OFO include:

- cost savings,

- access to a wide range of specialized expertise,

- flexibility in selecting service providers, and

- the ability to scale services according to the families' evolving needs.

OFOs provide a customizable approach to family office services, enabling clients to choose the most suitable providers for their unique financial requirements.

Structure of Outsourced Family Office

Overview of the Alpha OFO structure

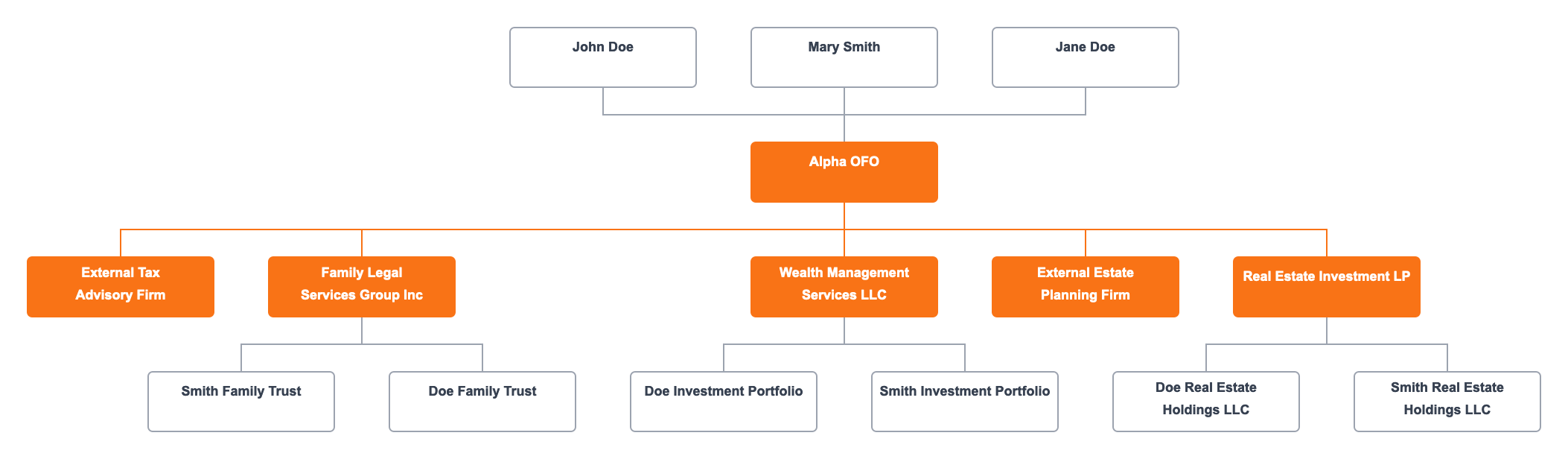

The Alpha OFO serves three high net-worth individuals: John and Jane Doe, and Mary Smith. The OFO structure comprises various service providers, including in-house subsidiaries and external firms, all dedicated to managing different aspects of the families' financial affairs, such as wealth management, legal services, real estate investments, tax advisory, and estate planning.

Connections between high net-worth individuals and Alpha OFO

Each high net-worth individual is directly connected to the Alpha OFO, which serves as the central point for coordinating and managing the various outsourced services on behalf of the families. This connection allows the OFO to tailor its services to each family and ensure that their specific financial needs and goals are addressed.

High Net-Worth Individuals

John Doe and Jane Doe

John and Jane Doe are high net-worth individuals who have chosen to utilize the services of Alpha OFO to manage their wealth and investments. By connecting to the OFO, they can access a wide range of specialized services that cater to their unique financial needs.

Mary Smith

Mary Smith is another high net-worth individual who has opted to use the services of Alpha OFO for managing her wealth and investments. Like the Doe family, she benefits from the customizable and comprehensive services provided by the OFO and its network of external providers.

In-House Subsidiaries

Wealth Management Services LLC

Wealth Management Services LLC is an in-house subsidiary of Alpha OFO that provides investment management and financial planning services to both the Doe and Smith families. It is responsible for managing their investment portfolios, ensuring that the families' wealth is managed according to their preferences and goals.

Family Legal Services Group Inc

Family Legal Services Group Inc is another in-house subsidiary of Alpha OFO, responsible for providing legal support and services to both families. It manages the Doe and Smith Family Trusts, ensuring that the trusts receive specialized legal advice and guidance.

Real Estate Investment LP

Real Estate Investment LP is a subsidiary of Alpha OFO that manages the real estate investments of both families. It is responsible for the Doe and Smith Real Estate Holdings LLCs, providing dedicated management and investment support for the families' real estate assets.

External Service Providers

External Tax Advisory Firm

The External Tax Advisory Firm is an independent entity that works in collaboration with Alpha OFO to provide tax advisory services for the Doe and Smith families. This connection allows the families to access specialized tax advice and planning services, ensuring that their financial affairs are managed efficiently from a tax perspective.

External Estate Planning Firm

The External Estate Planning Firm is another independent entity that collaborates with Alpha OFO to provide estate planning services for the families. By leveraging the expertise of this external provider, the families can ensure that their estate planning needs are addressed by professionals with in-depth knowledge and experience in the field.

Family Trusts

Doe Family Trust

The Doe Family Trust is a legal arrangement created by John and Jane Doe to manage, protect, and distribute their assets according to the terms set by them. The trust holds various assets, such as investments and real estate, and is used for estate planning, tax planning, and wealth preservation purposes.

Smith Family Trust

The Smith Family Trust is a similar legal arrangement created by Mary Smith to manage her assets. Like the Doe Family Trust, it is used for estate planning, tax planning, and wealth preservation purposes.

Real Estate Holdings

Doe Real Estate Holdings LLC

Doe Real Estate Holdings LLC is an entity that holds and manages the real estate assets of the Doe family. It is connected to Alpha OFO's Real Estate Investment LP, which provides investment support and management services for the Doe family's real estate portfolio.

Smith Real Estate Holdings LLC

Smith Real Estate Holdings LLC is an entity that holds and manages the real estate assets of the Smith family. Like the Doe Real Estate Holdings LLC, it is connected to Alpha OFO's Real Estate Investment LP, which provides investment support and management services for the Smith family's real estate portfolio.

Conclusion

The Alpha Outsourced Family Office (OFO) structure is designed to provide comprehensive and customized financial, legal, and real estate services to multiple high net-worth families while allowing for flexibility in addressing their specific needs. The OFO connects individuals to their wealth management entities, family trusts, and real estate holdings through a network of specialized subsidiaries and external service providers.

This structure allows families to outsource various aspects of their financial management while retaining the benefits of a comprehensive family office service. By utilizing the services of an OFO, high net-worth families can benefit from cost savings, access to a wider range of expertise, and the ability to collaborate with other families for greater investment opportunities.

This chart is made with Lexchart for automatic organization charts.