How to Structure a Multi-Family Office

Introduction to Multi-Family Offices (MFO)

Definition of Multi-Family Office

A Multi-Family Office (MFO) is a professional organization that provides comprehensive financial and wealth management services to more than one high net-worth families. MFOs offer a range of services, including investment management, estate planning, tax planning, and legal support.

Benefits of using an MFO

The benefits of using an MFO include:

- cost savings,

- access to a wider range of expertise, and

- the ability to pool resources with other families for greater investment opportunities.

By sharing costs among multiple clients, MFOs can provide high-quality services at a lower price compared to a single-family office.

Structure of an MFO

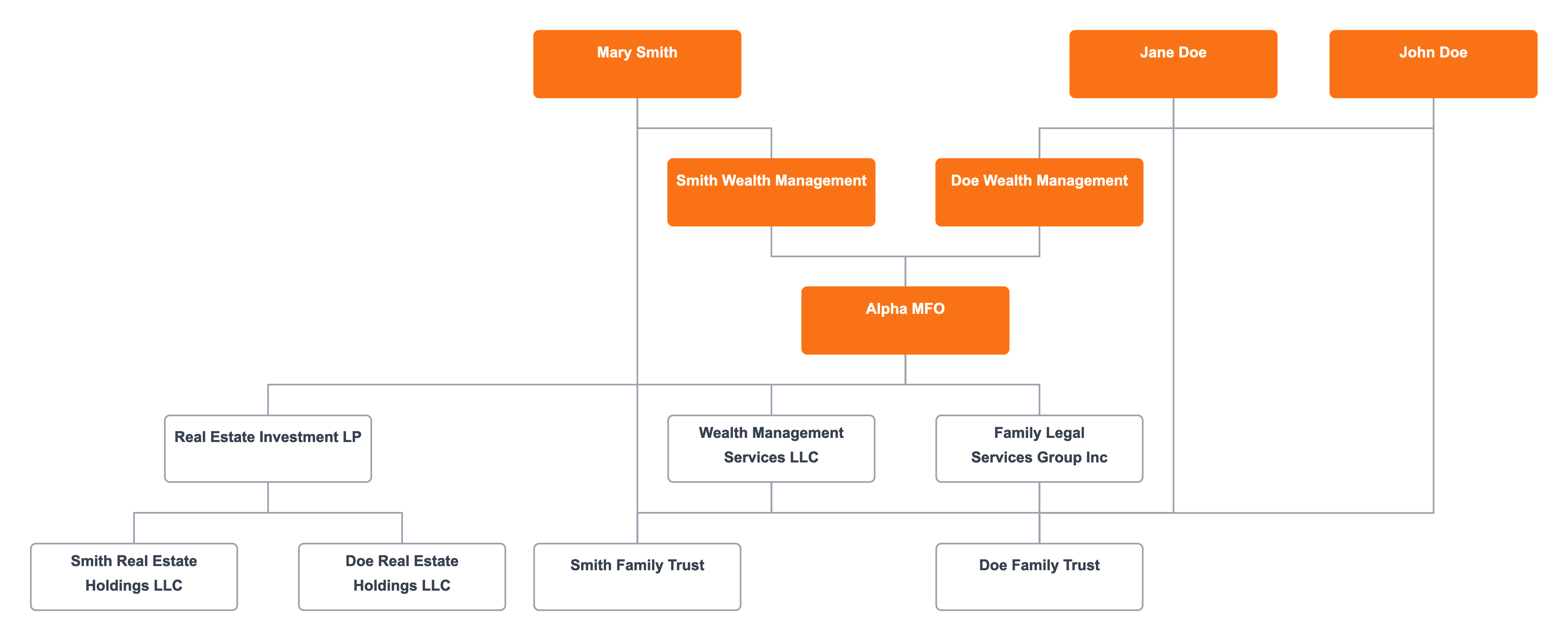

This is an example of a multi-family office called Alpha MFO.

Overview of the Alpha MFO structure

The Alpha MFO serves two families: the Doe family (John and Jane Doe) and the Smith family (Mary Smith). The MFO structure comprises various entities, including wealth management entities, family trusts, and real estate holdings, all connected to the MFO and its core service subsidiaries.

Connections between high net-worth individuals and their wealth management entities

Each high net-worth individual is connected to their respective wealth management entity: John and Jane Doe to Doe Wealth Management, and Mary Smith to Smith Wealth Management. These connections ensure that the families receive customized financial services and that their wealth is managed according to their specific needs and goals.

Services provided by Alpha MFO

Alpha MFO provides a range of services through its subsidiaries: Wealth Management Services LLC, Family Legal Services Group Inc, and Real Estate Investment LP. These subsidiaries cater to the needs of both the Doe and Smith families, providing tailored solutions to manage their wealth, legal matters, and real estate investments.

High Net-Worth Individuals

John Doe and Jane Doe

John and Jane Doe are high net-worth individuals who have chosen to utilize the services of Alpha MFO to manage their wealth and investments. They are connected to Doe Wealth Management, which represents their interests within the MFO.

Mary Smith

Mary Smith is another high net-worth individual who is a client of Alpha MFO. She is connected to Smith Wealth Management, which is responsible for managing her wealth and investments within the MFO.

Objectives of connecting individuals to their wealth management entities

The primary objective of connecting high net-worth individuals to their wealth management entities is to ensure that their financial needs and goals are addressed within the MFO. This connection allows the MFO to tailor its services to each family, providing customized wealth management, tax planning, and estate planning solutions.

Wealth Management Entities

Doe Wealth Management

Doe Wealth Management is the entity responsible for managing the financial assets and investments of John and Jane Doe within the Alpha MFO. It works closely with the MFO's subsidiaries to provide tailored financial services to the Doe family.

Smith Wealth Management

Smith Wealth Management is the entity responsible for managing the financial assets and investments of Mary Smith within the Alpha MFO. It collaborates with the MFO's subsidiaries to provide customized financial services to the Smith family.

Objectives of connecting wealth management entities to Alpha MFO

The main objective of connecting wealth management entities to Alpha MFO is to facilitate the provision of comprehensive and customized financial services to the families. This connection allows the MFO to pool resources, share expertise, and manage the wealth of multiple families efficiently, while maintaining a level of separation between their assets.

Multi-Family Office Core Services

Wealth Management Services LLC

Wealth Management Services LLC is a subsidiary of Alpha MFO that provides investment management and financial planning services to both the Doe and Smith families. It is connected to their respective family trusts, ensuring that the families' wealth is managed according to their preferences and goals.

Family Legal Services Group Inc

Family Legal Services Group Inc is another subsidiary of Alpha MFO, responsible for providing legal support and services to both families. It is connected to the Doe and Smith Family Trusts, ensuring that the trusts receive specialized legal advice and guidance.

Real Estate Investment LP

Real Estate Investment LP is a subsidiary of Alpha MFO that manages the real estate investments of both families. It is connected to Doe Real Estate Holdings LLC and Smith Real Estate Holdings LLC, providing dedicated management and investment support for the families' real estate assets.

Objectives of connecting Alpha MFO to its subsidiaries

The primary objective of connecting Alpha MFO to its subsidiaries is to provide comprehensive and specialized services to its clients. This connection ensures that the MFO can effectively manage the wealth, legal matters, and real estate investments of multiple families while maintaining a clear delineation of their assets.

Family Trusts

Doe Family Trust

The Doe Family Trust is a legal arrangement created by John and Jane Doe to manage, protect, and distribute their assets according to the terms set by them. The trust holds various assets, such as investments and real estate, and is used for estate planning, tax planning, and wealth preservation purposes.

Smith Family Trust

The Smith Family Trust is a similar legal arrangement created by Mary Smith to manage her assets. Like the Doe Family Trust, it is used for estate planning, tax planning, and wealth preservation purposes.

Objectives of connecting high net-worth individuals to their trusts

The main objective of connecting high net-worth individuals to their trusts is to provide a structured and secure way to manage their wealth and assets. This connection ensures that the assets are managed according to the individuals' preferences and goals and provides benefits such as asset protection, tax efficiency, and estate planning.

Objectives of connecting trusts to Alpha MFO's core services

Connecting the trusts to Alpha MFO's core services ensures that the families receive comprehensive and specialized support in managing their wealth, legal matters, and real estate investments. This connection enables the MFO to provide tailored solutions to each family while maintaining a clear separation of their assets.

Real Estate Holdings

Doe Real Estate Holdings LLC

Doe Real Estate Holdings LLC is an entity that holds and manages the real estate assets of the Doe family. It is connected to Alpha MFO's Real Estate Investment LP, which provides investment support and management services for the Doe family's real estate portfolio.

Smith Real Estate Holdings LLC

Smith Real Estate Holdings LLC is an entity that holds and manages the real estate assets of the Smith family. Like the Doe Real Estate Holdings LLC, it is connected to Alpha MFO's Real Estate Investment LP, which provides investment support and management services for the Smith family's real estate portfolio.

Objectives of connecting real estate holdings to Alpha MFO's Real Estate Investment LP

The main objective of connecting the real estate holdings to Alpha MFO's Real Estate Investment LP is to provide professional management and investment support for the families' real estate assets. This connection allows the MFO to pool resources and expertise to manage the real estate investments efficiently while maintaining a clear delineation between the Doe and Smith families' assets.

Conclusion

The Multi-Family Office (MFO) structure is designed to provide comprehensive and customized financial, legal, and real estate services to multiple high net-worth families. The MFO connects individuals to their wealth management entities, family trusts, and real estate holdings through a network of specialized subsidiaries.

This structure allows the MFO to pool resources, share expertise, and manage the wealth of multiple families efficiently while maintaining a clear separation of their assets. By utilizing the services of an MFO, high net-worth families can benefit from cost savings, access to a wider range of expertise, and the ability to collaborate with other families for greater investment opportunities.

This chart is made with Lexchart for automatic organization charts.