Corporate Structure Charts: The Ultimate Tool for Visualizing and Communicating Your Corporation's Ownership Structure

Corporate structure charts are visual representations of a corporation's ownership hierarchy. They show the relationships between the corporation, its shareholders, and its various classes of stock. Understanding how to accurately show shareholders in a corporate structure chart is important for clearly communicating the ownership structure of a corporation.

What are the elements of corporate structure charts?

Corporate structure charts consist of a hierarchy of cards, links, and ownership information.

Corporate structure charts show the ownership of a corporation as a hierarchy

Corporate structure charts show the ownership of a corporation as a hierarchy. This hierarchy is typically represented using cards (boxes) and links (lines), with the corporation at the bottom and shareholders at the top (although that order can be reversed).

The cards in the chart represent individuals legal entities within the hierarchy. The links between the cards represent ownership between the cards.

By showing the ownership of a corporation as a hierarchy, corporate structure charts provide a clear and visual representation of the relationships between the corporation and its shareholders. This can be useful for understanding the power dynamics within the organization and the roles and responsibilities of each shareholder.

Corporate structure charts can provide transparency and accountability within the organization by showing the ownership structure of the corporation.

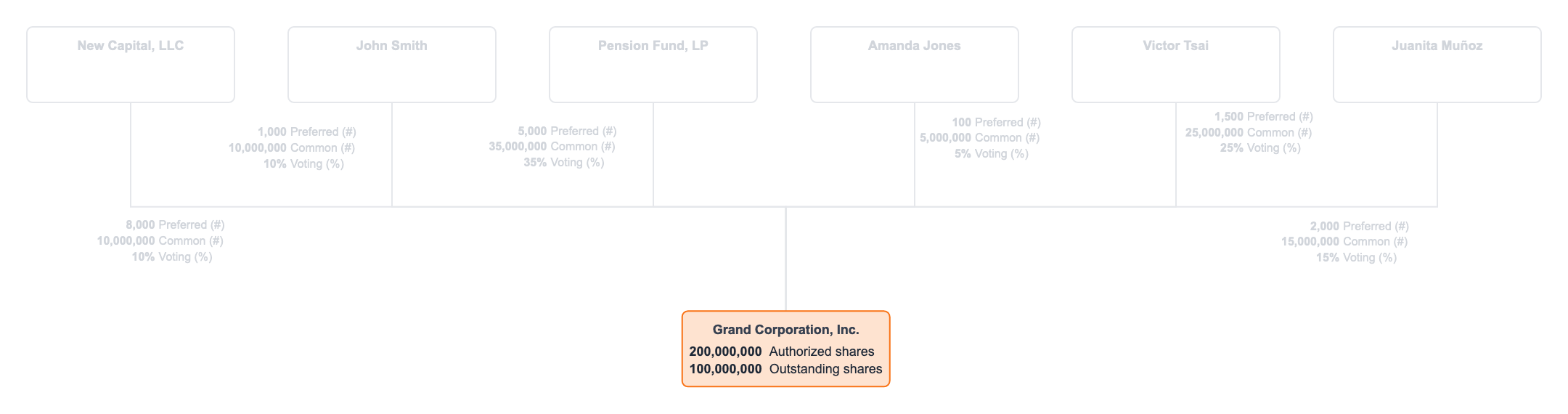

Corporate structure charts can show authorized, outstanding, and treasury stock

Corporate structure charts can show authorized, outstanding, and treasury stock.

Authorized stock is the maximum number of shares that a corporation is legally allowed to issue. This is determined by the corporation's articles of incorporation or other governing documents.

Outstanding stock refers to the shares that have been issued and are currently held by shareholders. This includes both common and preferred stock that has been issued by the corporation.

Treasury stock is stock that is held or has been repurchased by the corporation and is not currently held by shareholders.

It is important to include information about authorized, outstanding, and treasury stock in a corporate structure chart because it provides a complete picture of the corporation's ownership structure. It can also be useful for understanding the corporation's financial position and its ability to issue new shares in the future.

Classifying the stock for a corporate structure chart

There are several different classes of corporate stock:

Common stock

Common stock is the most common class of stock issued by corporations. It represents ownership in the corporation and entitles the holder to vote at shareholder meetings and to receive dividends.

Preferred stock

Preferred stock is a class of stock that has a higher claim on the corporation's assets and earnings than common stock. Preferred stockholders may be entitled to receive dividends at a fixed rate, and they may have priority over common stockholders in the event that the corporation is liquidated.

Class A and Class B stock

Corporations may issue multiple classes of common or preferred stock, such as Class A and Class B stock. These classes may have different voting rights or dividend payments, or they may be issued with different terms and conditions.

Employee stock options

Employee stock options are a type of equity compensation that gives employees the right to purchase a specific number of shares of the corporation's stock at a fixed price. Employee stock options are typically granted as a form of compensation and may vest over time, meaning that the employee must meet certain conditions before they can exercise their options.

Warrants

Warrants are a type of securities that give the holder the right, but not the obligation, to purchase a specific number of shares of the corporation's stock at a fixed price. Warrants are often issued in conjunction with bonds or other securities and may have a longer term than options.

Convertible securities

Convertible securities are a type of securities that can be converted into a different form of security, such as common or preferred stock. Convertible bonds, for example, are bonds that can be converted into a specific number of shares of common or preferred stock at the holder's discretion. Convertible preferred stock is preferred stock that can be converted into a specific number of shares of common stock at the holder's discretion.

Each class of corporate stock has its own rights and privileges, which are outlined in the corporation's articles of incorporation or other governing documents. It is important to accurately classify the stock in a corporate structure chart so that readers can understand the rights and privileges of each class of shareholder.

The corporate structure can display the types of stock relevant to the chart.

Identifying shareholders in a corporate structure chart

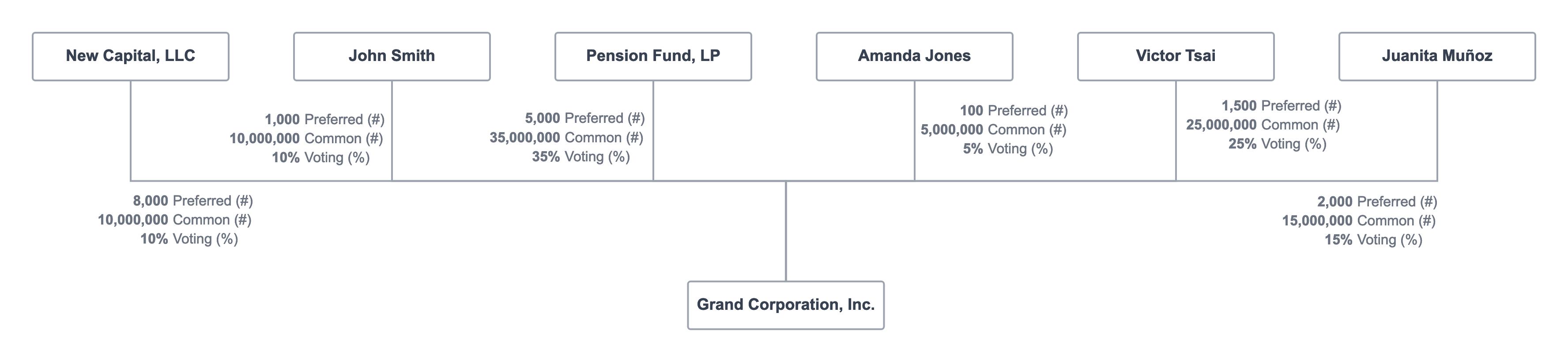

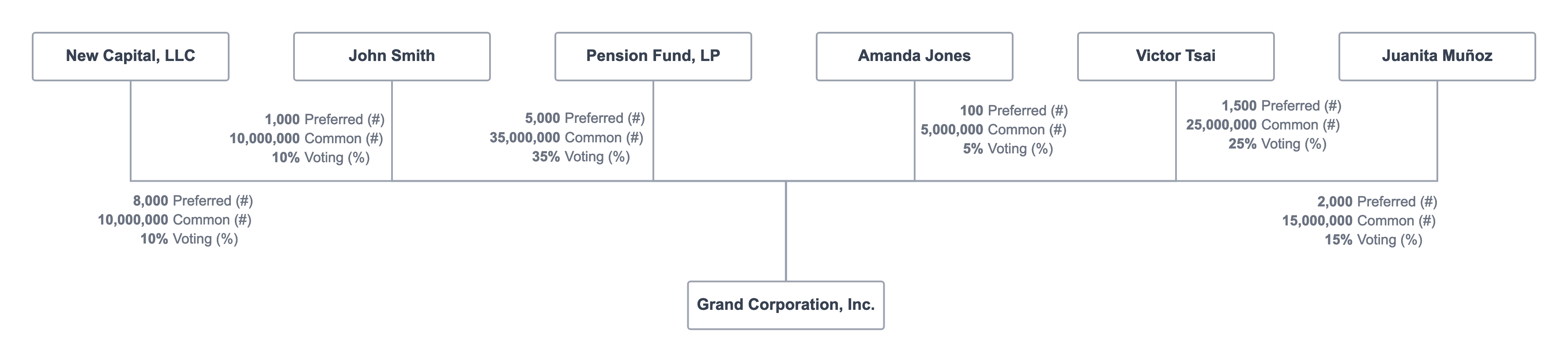

Identifying a list of shareholders is an important step in creating a corporate structure chart. A shareholder is an individual or entity that owns shares of stock in a corporation. For example, Grand Corporation, Inc. might have these shareholders:

| Shareholder | Preferred (#) | Common (#) | Voting (%) |

|---|---|---|---|

| John Smith | 1,000 | 10,000,000 | 10% |

| Juanita Muñoz | 2,000 | 15,000,000 | 15% |

| Victor Tsai | 1,500 | 25,000,000 | 25% |

| Amanda Jones | 100 | 5,000,000 | 5% |

| Pension Fund, LP | 5,000 | 35,000,000 | 35% |

| New Capital, LLC | 8,000 | 10,000,000 | 10% |

To create a list of shareholders, you will need to gather information about the classes of stock that have been issued by the corporation and the number of shares held by each shareholder. This may involve reviewing the corporation's records, including its articles of incorporation and stock register, as well as any other documents related to the issuance of stock.

Once you have identified the classes of stock and the number of shares held by each shareholder, you can create a list of shareholders. For each shareholder, you will need to include information about their shareholdings, such as the class of stock they hold, the number of shares they own, and their ownership percentage.

Ownership percentage refers to the percentage of the total number of shares in the corporation that are held by a particular shareholder. This can be calculated by dividing the number of shares held by the shareholder by the total number of outstanding shares in the corporation.

Equity stake refers to the total value of a shareholder's holdings in the corporation, which is calculated by multiplying the number of shares held by the shareholder by the current market value of the stock.

Representing shareholders in a corporate structure chart

Representing shareholders in a corporate structure chart involves adding a card (or box) for each shareholder and adding ownership information to the links between the corporation and the shareholder boxes. By adding a box for each shareholder and linking it to the corporation, you can show the ownership relationship between the shareholder and the corporation.

To represent shareholders in a corporate structure chart, you will need to include information about the shareholder's shareholdings, such as the class of stock they hold, the number of shares they own, and their ownership percentage.

You might want to include information about the shareholder's equity stake, which is the total value of their holdings in the corporation. If a shareholder holds more than one class of stock, you will want to include separate lines of labels and data for each class of stock to clarify the rights and privileges of each class of shareholder.

Best practices for including shareholders in a corporate structure chart

There are several best practices to follow when showing shareholders in a corporate structure chart.

Rely on the automated hierarchy

One best practice is to rely on the automated hierarchy of the corporate structure chart software you are using, such as Lexchart. Lexchart has a sophisticated algorithm built specifically for corporate hierarchy charts.

These features include automated layout algorithms, automatic formatting options, and the ability to import data directly from your organization's records. By relying on the automated hierarchy of your corporate structure chart software, you can save time and reduce the risk of errors.

Show the timing of ownership

Another best practice is to show the timing of ownership in your corporate structure chart. This can be particularly important for corporations that have gone through multiple rounds of financing or have had changes in their ownership structure over time. By showing the timing of ownership, you can provide a more complete picture of the corporation's ownership history and help readers understand the evolution of the organization.

Use words instead of shapes

Using words instead of shapes in your corporate structure chart can make it easier for readers to understand the relationships between elements in the chart. For example, instead of using circles or squares to represent different classes of stock, you can use words like "common stock" or "preferred stock." This can help clarify the rights and privileges of each class of shareholder and make it easier for readers to follow the chart.

Use color with purpose

Using color in your corporate structure chart can help highlight important information and make the chart more visually appealing. However, it's important to use color with purpose, not just for decorative purposes.

Choose a limited palette of colors and use them consistently to represent different elements in the chart. For example, you might use one color to represent the corporation and a different color to represent each class of shareholder. This can help readers quickly identify different elements in the chart and better understand the relationships between them.

Even better, use color to highlight a branch, card, or particular relationship under consideration.

Conclusion: The importance of accurately showing shareholder relationships in a corporate structure chart

A corporate structure chart is a visual representation of a corporation's ownership hierarchy and the relationships between the corporation, its shareholders, and its various classes of stock.

By showing shareholder relationships in a corporate structure chart, you can provide a clear and complete picture of the corporation's ownership structure. This can help foster communication and collaboration among ownership, management, and external stakeholder like creditors and regulators.