Capital One and Discover Merger Deal Structure

Capital One and Discover announced a merger agreement February 19, 2024. Both companies include a discussion of the merger in their annual 10-K filings with the SEC. The merger is subject to regulatory approval. This article visualizes the organizational structure of each stage of the merger.

Capital One Financial Corporation (NYSE: COF) and Discover Financial Services (NYSE: DFS) are two of the largest credit card issuers in the United States. Both companies offer a broad array of financial products and services to consumers, small businesses, and commercial clients.

Capital One and Discover are members of the S&P 500. Capital One is a Delaware corporation, headquartered in McLean, Virginia. Discover is a Delaware corporation, headquartered in Riverwoods, Illinois.

The org charts in this article are made with Lexchart for automatic organization charts.

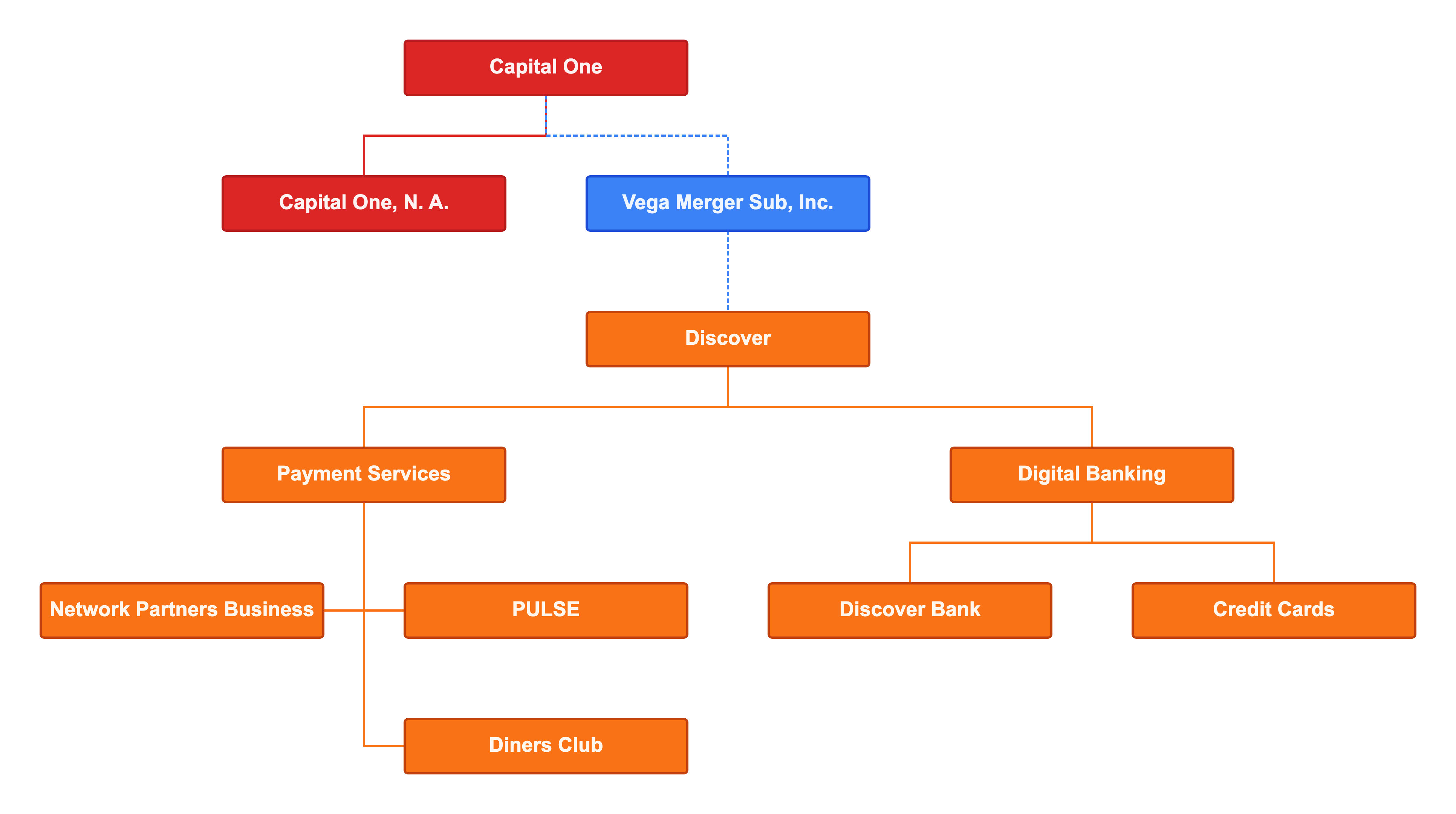

Capital One Discover Merger Deal Structure

Capital One says that they will complete the acquisition in two steps, using a newly formed subsidiary to merge with Discover, and then merging Discover with Capital One. The deal also includes a merger of Discover Bank with Capital One Bank:

On February 19, 2024, the Company entered into an agreement and plan of merger (the “Merger Agreement”), by and among Capital One, Discover Financial Services, a Delaware corporation (“Discover”) and Vega Merger Sub, Inc., a Delaware corporation and a direct, wholly owned subsidiary of the Company (“Merger Sub”), pursuant to which (a) Merger Sub will merge with and into Discover, with Discover as the surviving entity in the merger (the “Merger”); (b) immediately following the Merger, Discover, as the surviving entity, will merge with and into Capital One, with Capital One as the surviving entity in the second-step merger (the “Second Step Merger”); and (c) immediately following the Second Step Merger, Discover Bank, a Delaware-chartered and wholly owned subsidiary of Discover, will merge with and into CONA, with CONA as the surviving entity in the merger (the “CONA Bank Merger,” and collectively with the Merger and the Second Step Merger, the “Transaction”). The Merger Agreement was unanimously approved by the Boards of Directors of each of Capital One and Discover.

This merger structure provides an excellent way to use the automatic organization chart features in Lexchart to visualize how Vega Merger Sub, Inc. will work.

Pre-Merger Ownership Structure

Capital One discloses only one material subsidiary in Exhibit 21 of its 10-K: Capital One Bank (USA), N.A. You can see Capital One's organization chart for its owners.

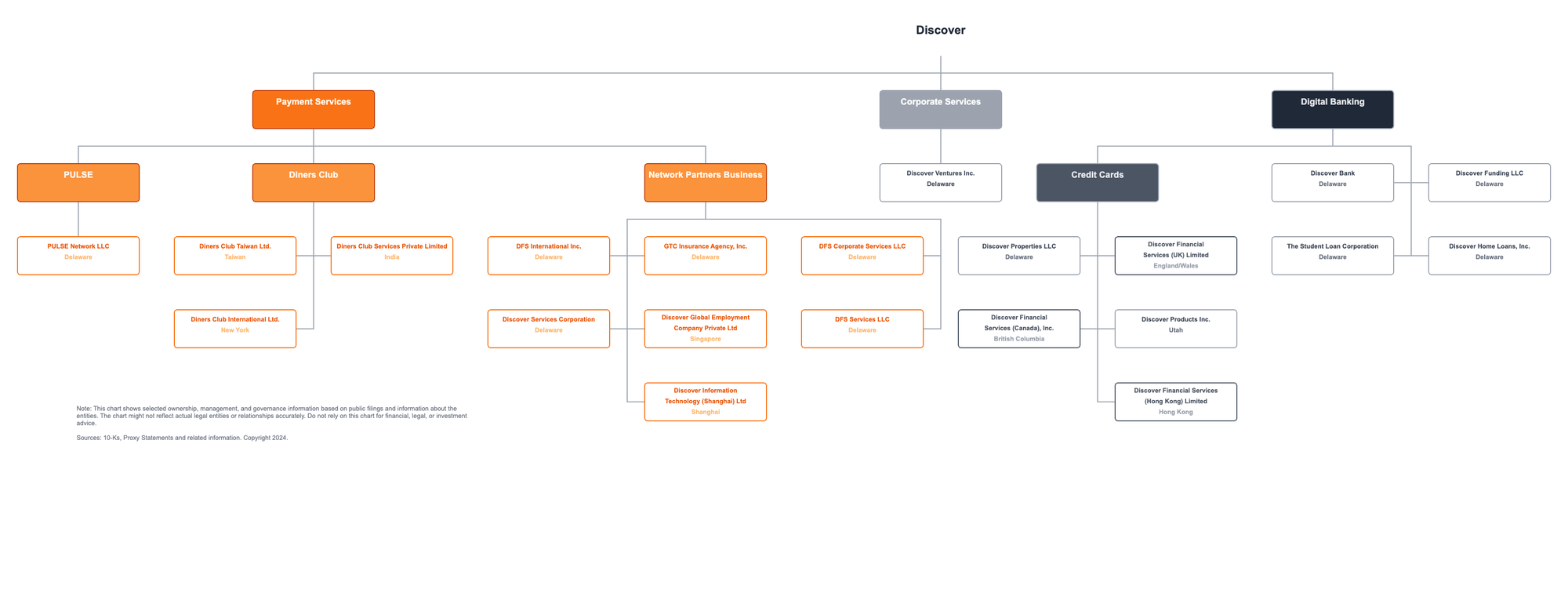

Discover has a more elaborate list of subsidiaries in Exhibit 21 of its 10-K, including Discover Bank, DFS Services LLC, and Discover Products Inc.

You can access a free, interactive version of this Discover Subsidiaries chart that includes panning and zooming to explore the details. Read a discussion of Discover's organization chart for owners. You can also read about the Discover subsidiaries org chart.

Seeing the organization charts for both companies on the same canvas is useful. We simplified the subsidiary structure of Discover in the following diagram. This diagram also shows Capital One's Vega Merger Sub, Inc.:

Step 1. Merger Sub with Discover

The first step of the merger is for Capital One to form a new subsidiary, Vega Merger Sub, Inc., which will merge with Discover as the surviving entity.

Check out the interactive version of this Capital One / Discover merger diagram.

Step 2. Discover with Capital One

The second step of the merger is for Discover to merge with Capital One as the surviving entity.

Step 2 also includes the merger of Discover Bank with Capital One Bank. That move is highlighted in the following diagram:

The interactive version of step 2 in the Capital One / Discover merger is available.

Conclusion

As of this writing it is not clear whether the merger will receive regulatory approval. The deal does, however, provide a great example of using the artificial intelligence of Lexchart to dynamically visualize the ownership structure of a complex merger.

References

2023 10-K Annual Report for Capital One Financial Corporation

Most recent Capital One Proxy Statement (DEF 14A) filed with the SEC

SEC Filings for Capital One Financial Corporation

2023 10-K Annual Report for Discover Financial Services

2023 Discover Financial Services Proxy Statement (DEF 14A) filed with the SEC