How to Structure Business Acquisitions

There are three ways to grow your business. You can build the business organically. You can partner with another business. And, you can buy another business. Growth through acquisition is a strategy for companies of all sizes.

There are two ways to buy a business. You can buy the assets underlying the business.

Or, you can buy the shares in the legal entity that owns the assets.

Business acquisitions are structured as either an asset purchase or a company purchase (also known as a "stock purchase"). The choice influences price, taxes, and risk.

Watch a video version of this article

Acquisition target

The Acquirer

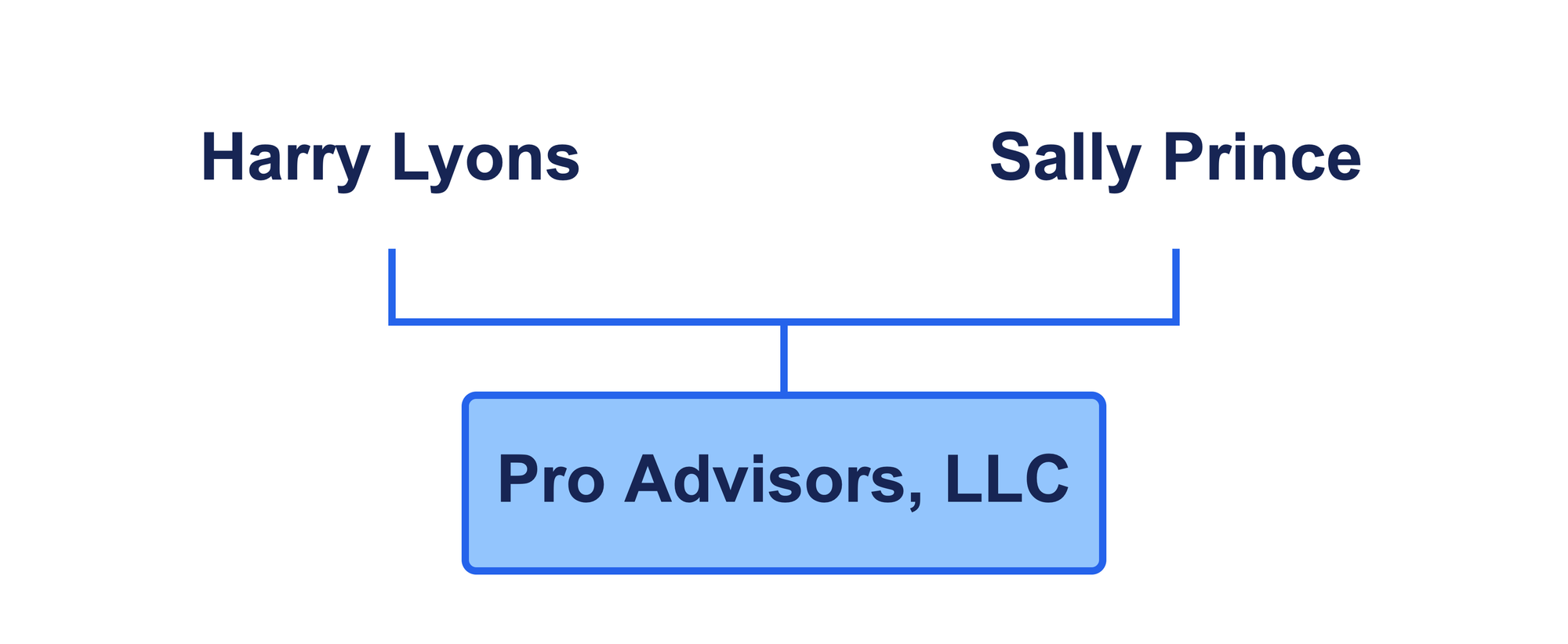

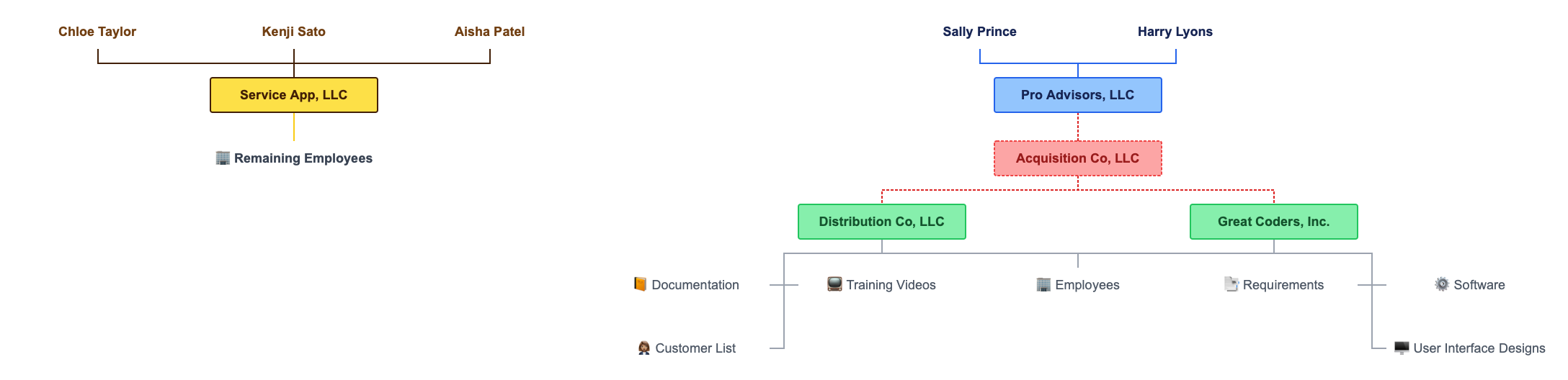

Imagine Harry and Sally own Pro Advisors, LLC. They provide a variety of consulting services for businesses in an industry vertical. Pro Advisors is a member managed LLC (see also Types of LLCs).

They have decided to expand their business through acquisition. They want to buy a technology company to augment their services revenue with product sales. Pro Advisors is the "Acquirer."

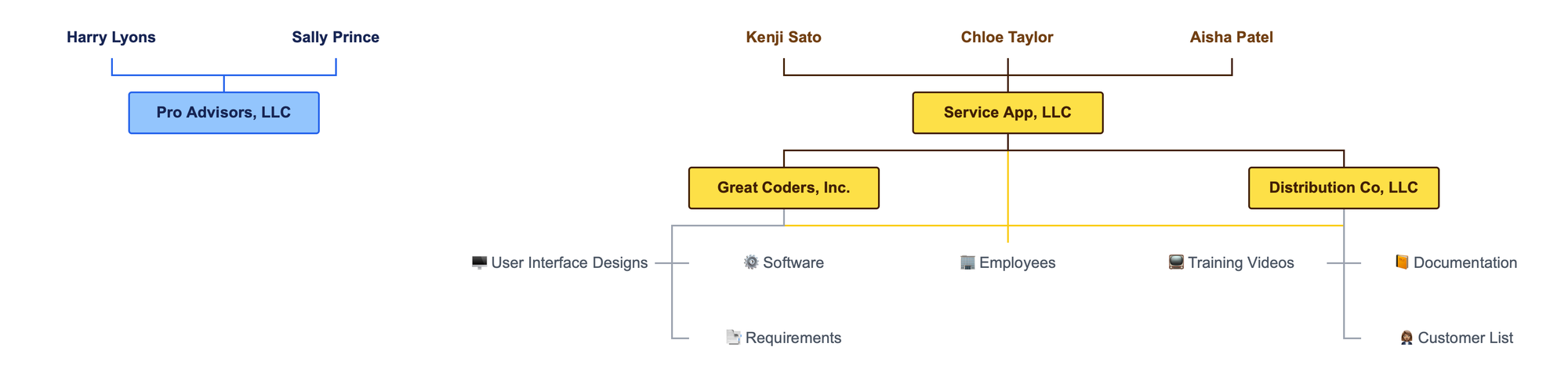

The Target

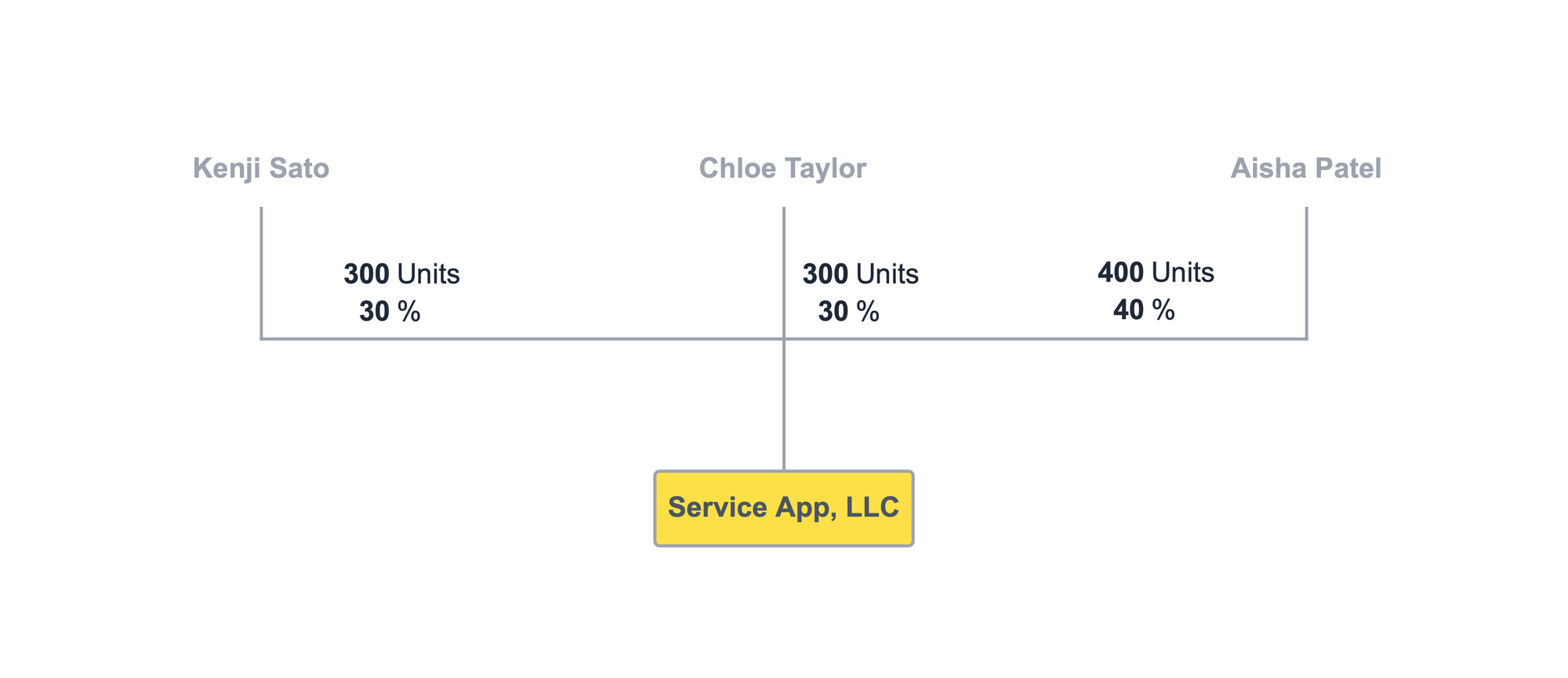

Now imagine Service App, LLC develops and sells an application that is widely used in the same vertical as Pro Advisors. Service App is a strategic "Target" for Pro Advisors.

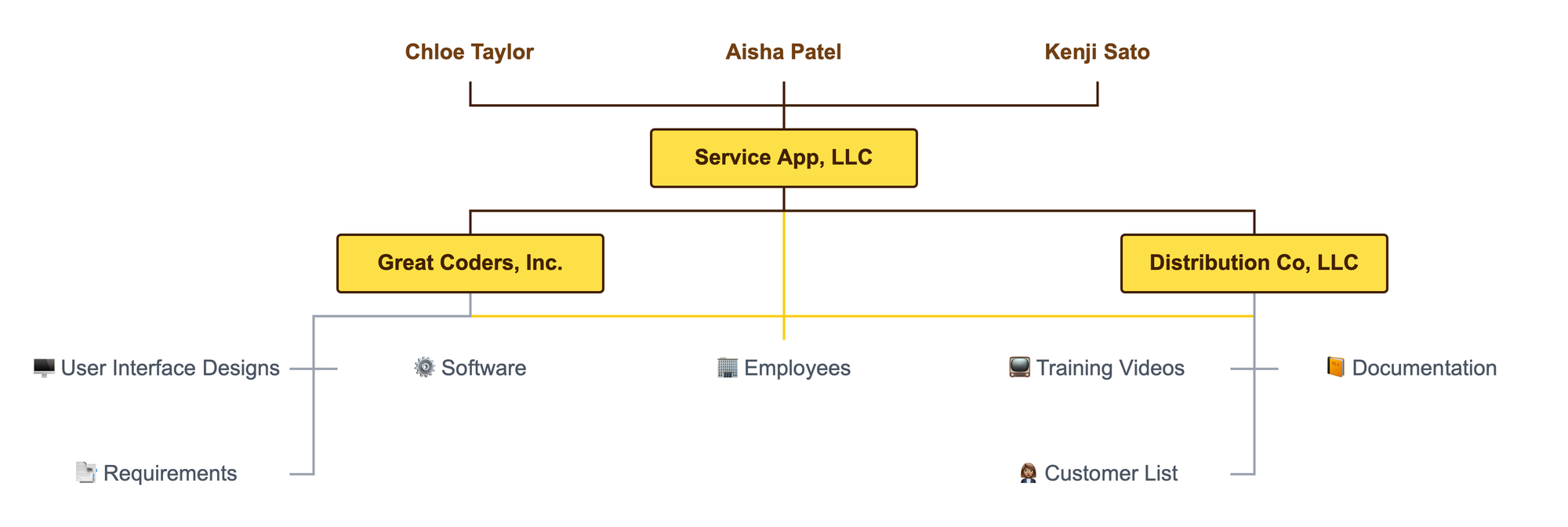

Service App uses two subsidiaries to build and sell its web application.

Great Coders is the entity that develops and owns the intellectual property. Distribution Co markets and sells the application. All three entities have employees.

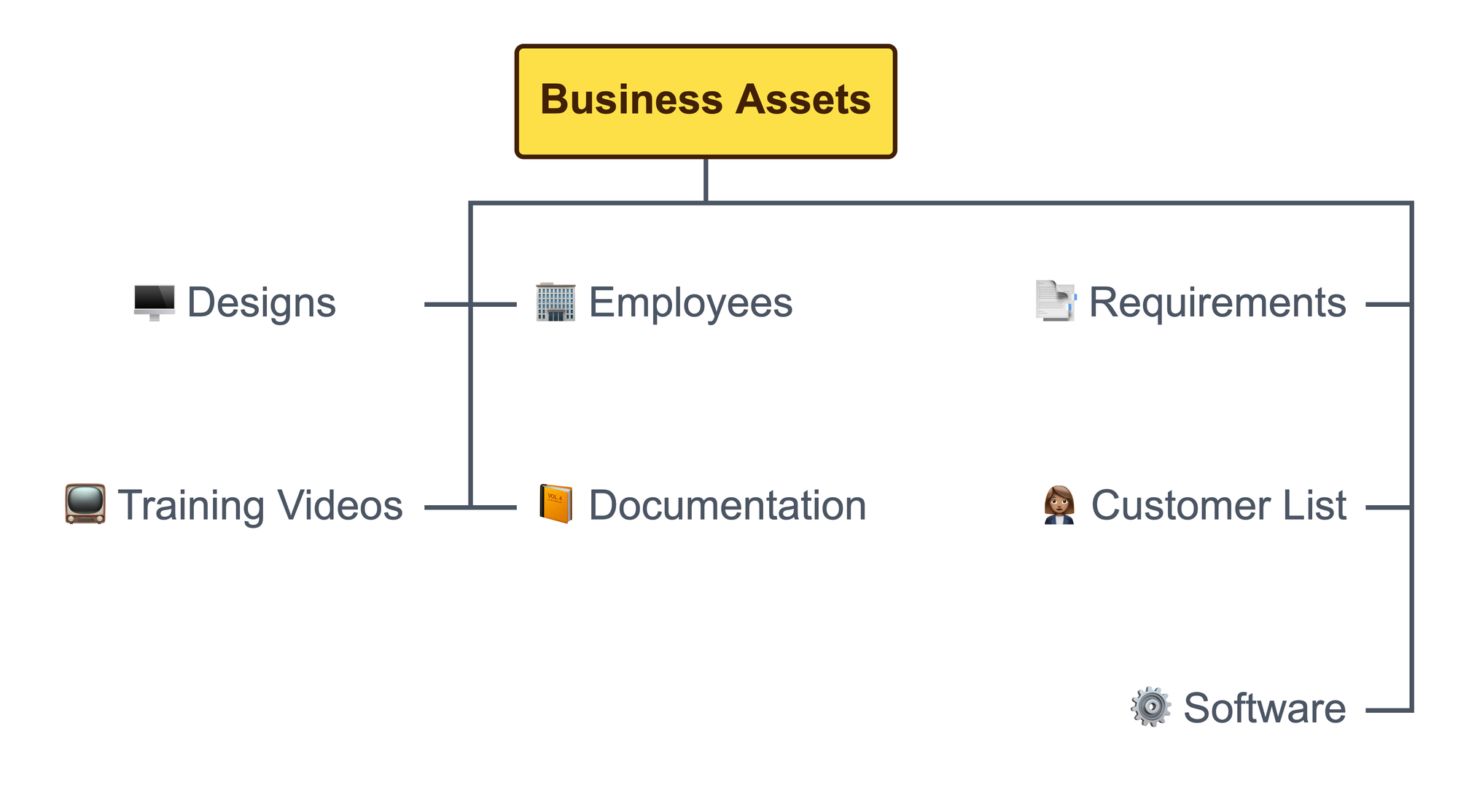

Through its subsidiaries, Service App has several valuable assets: User Interface Designs, Software Code, Requirements Documentation, Training Videos, User Documentation, and a Customer List. The business also has employees who are critical to the business, but they are not "assets" in the same way.

The Deal Structure

What exactly does the Acquirer buy from the Target? The answer depends on the deal structure.

Both parties have preferences about how to structure the acquisition. We need to distinguish between the assets of the business and the ownership of those assets.

Asset Purchase

When Pro Advisors completes an asset purchase of the Service App business, it hollows out Service App's subsidiaries, leaving them behind.

There are tax and legal benefits for the Acquirer to purchase just the assets of the Target. Most important, the liabilities of the Target are not transferred to the Acquirer. The liabilities left behind might include loans, litigation exposure, underfunded employee benefits, and the like.

Notice that Service App and its subsidiaries retain their employees, because they cannot sell an employee to an acquirer. However, deals to sell a business through an asset sale often include a mechanism for the Acquirer to hire the employees necessary for the business. Otherwise, Pro Advisors would see the value of the acquisition decline quickly without people to maintain and sell the application.

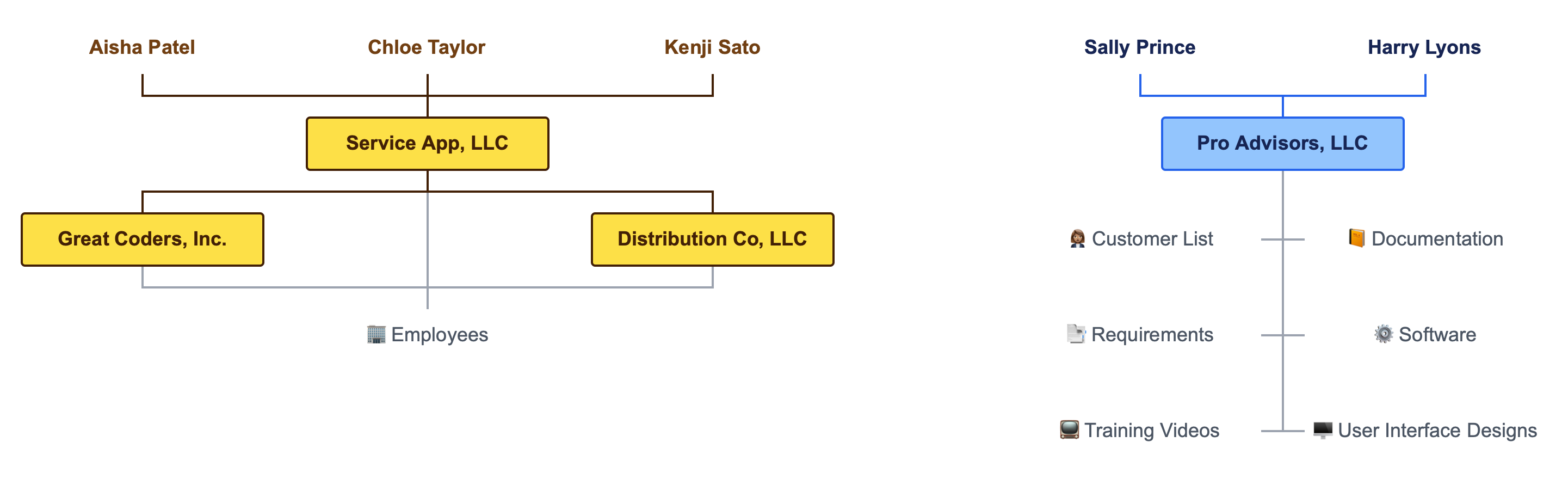

Stock Purchase of Subsidiaries

An alternative approach in this example is for the Acquirer to purchase the subsidiaries of the business: Great Coders and Distribution Co. Pro Advisors buys the stock or membership units of the subsidiaries from Service App.

Notice how the employees who work directly for the subsidiaries move with the transaction. This is not because the Acquirer directly purchases the assets and the employees of the business. Rather, the Acquirer purchases the membership units and shares of the subsidiaries, taking on their obligations including employees.

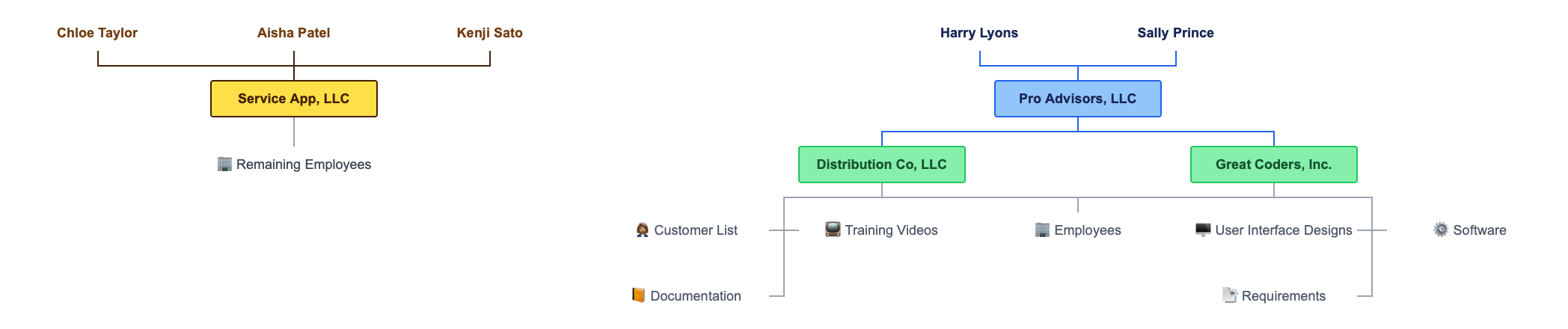

Stock Purchase of Whole Company

With similar logic, the Acquirer might purchase the entire legal entity from its prior owners. There are legal and tax consequences of this structure for both parties, but simplicity is certainly one of the benefits.

The Acquirer purchases the membership units of Service App. The assets, liabilities, and employees all come along for the ride.

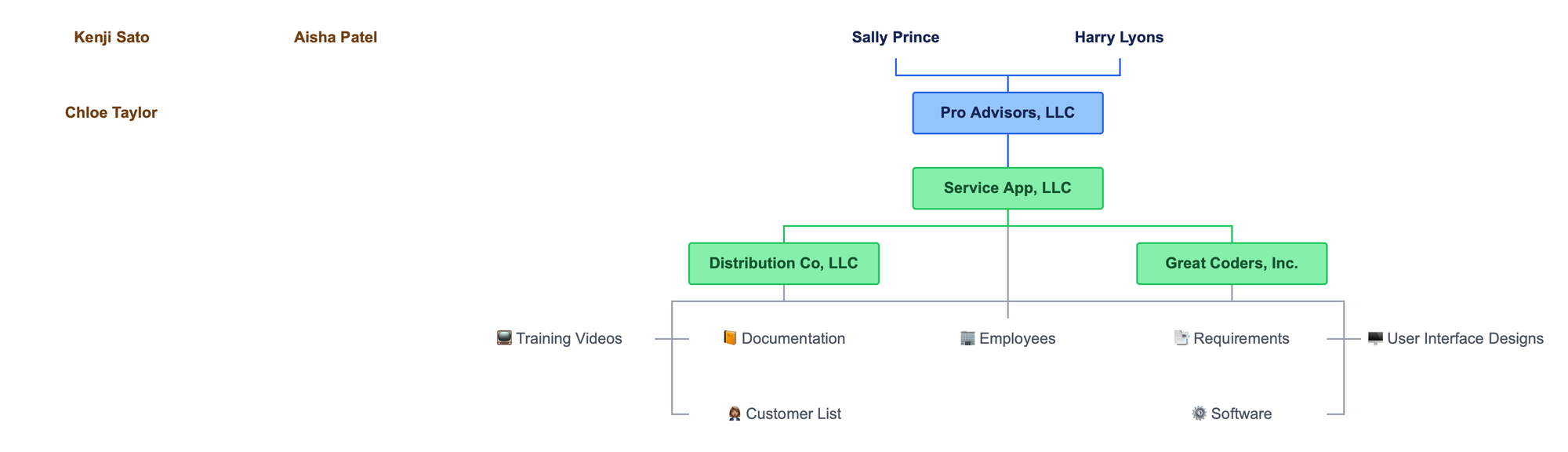

Variations

In another variation, Pro Advisors decides to form a new legal entity which will own the assets of the acquisition. They might create an intervening company to achieve tax objectives, to isolate legal risk, or to serve other purposes. Acquirers often create special purpose entities to complete a business acquisition.

In this example, Pro Advisors creates Acquisition Co, LLC to purchase the membership units and shares of Distribution Co and Great Coders.

Conclusion

While there are many permutations of these structures, business acquisitions boil down to either an asset purchase or a stock purchase.

This chart is made with Lexchart for automatic organization charts.